Foreign Direct Investment (FDI) is a type of cross-border investment where an investor residing in one country establishes a lasting interest in and significant influence over an enterprise dwelling in another economy. Foreign direct investment (FDI) is a crucial conduit for exchanging technology between nations, facilitates international trade by providing access to foreign markets, and can serve as a significant catalyst for economic progress.

Discover the impact of Foreign Direct Investment (FDI) in Bangladesh on its economy

Foreign direct investment (FDI) has considerable ramifications for Bangladesh’s economy, influencing numerous aspects:

Economic Growth: FDI contributes considerably to economic growth by injecting capital, technology, and managerial expertise. This impact is apparent across multiple sectors, including manufacturing, services, and infrastructure, and helps integrate the home economy with the global economy.

Employment Generation: FDI often leads to job creation directly within foreign enterprises and indirectly in adjacent industries. This can favorably impact employment rates and socio-economic situations and develop the productive capability of this country.

Technology Transfer: One of the significant benefits of FDI is the transfer of innovative technologies and managerial techniques. This infusion of expertise boosts local industries’ efficiency and productivity, thereby boosting global competitiveness.

Balance of Payments: Through the inflow of foreign money, FDI supports the balance of payments. This aids in decreasing trade deficits and boosts the country’s overall foreign financial standing.

Infrastructure Development: Foreign investors frequently contribute to infrastructure development by establishing factories, offices, and other structures. This benefits the investing corporations and enhances the country’s infrastructure.

Industry Diversification: Foreign Direct Investment (FDI) fosters diversification by mitigating reliance on particular sectors. This diversity promotes economic resilience by decreasing exposure to external economic downturns.

Government Revenue: Through taxes and other financial contributions, foreign businesses that operate in Bangladesh contribute to the government’s revenues. This additional revenue can be used to fund infrastructure improvements and public services. But it’s important to recognize that FDI’s effects depend on various variables, including international economic conditions, investment types, and policy frameworks.

Learn about Foreign Direct Investment (FDI) Trends

Due to the COVID-19 pandemic, millions of people’s everyday lives and companies have substantially changed since March 2020. Describing the epidemic as a serious hindrance to foreign direct investment (FDI) is an understatement. Remarkably, FDI inflows to established and transitioning economies fell by 58 percent in 2020. Among the developed markets, Europe was particularly heavily affected, with FDI inflows falling by 80%.

Many countries were already moving toward protectionist policies before the epidemic struck, and they were increasing their vigilance over new foreign investment. Since the epidemic, these patterns have been extrapolated due to new circumstances such as lockdowns, bottlenecks in global supply systems, and armed conflict.

Global foreign direct investment (FDI) bucked early estimates for 2023, expanding by 3% and closing the year at an estimated $1.37 trillion, according to UNCTAD’s latest Global Investment Trends Monitor published on January 17.

However, the analysis notes a critical subtlety: the overall upswing was driven mostly by a few European “conduit” economies, which often operate as intermediaries for FDI bound for other nations. Strikingly, when these conduit economies are eliminated, global FDI flows indicate a severe 18% fall in 2023. The rest of the European Union experienced a dramatic 23% fall, and the United States, the world’s biggest FDI receiver, saw a 3% dip.

The Association of Southeast Asian Countries (ASEAN), generally the catalyst behind FDI growth, suffered a 16% decline. Despite this, Greenfield project announcements in countries including Vietnam, Thailand, Indonesia, Malaysia, the Philippines, and Cambodia saw a 37% increase, indicating that the area remained attractive for industrial investments.

In contrast, FDI flows witnessed a minor 1% fall in Africa. They stayed consistent in Latin America and the Caribbean, partially due to advances in Central America and a significant 21% expansion in Mexico, the region’s second-largest economy.

Get insights into Bangladesh’s Investment Climate

Bangladesh is the world’s most densely populated nation, home to almost 165 million people in an area the size of Iowa, making it the seventh most populous country in the world. Bangladesh is located in the northeastern part of the Indian subcontinent, with a 4,100-kilometer border with India and a 247-kilometer border with Myanmar.

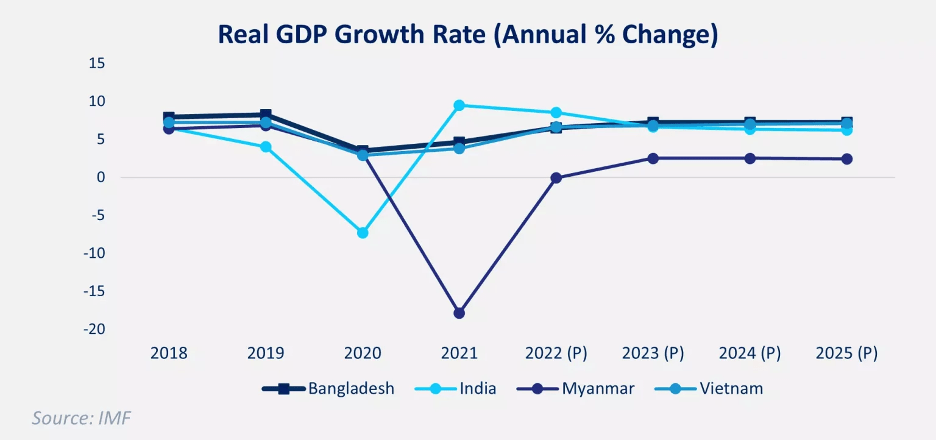

Despite the economic constraints brought on by COVID-19, Bangladesh’s booming workforce, strategic location spanning key Asian markets, and thriving private sector are primed to draw even more investment, propelled by a decade of sustained development.

Bangladesh has enjoyed a consistent GDP growth rate of more than six percent per year over the last ten years, thanks to its youthful workforce and growing consumer market, except for a slowdown in 2020 caused by the pandemic. The country’s outstanding growth is mostly driven by its ready-made garment (RMG) sector, which exported $35.81 billion in apparel products in fiscal year 2021, following only China. In the same fiscal year, remittance inflows reached $24.77 billion. Notably, post-COVID global demand for garments drove a 30% year-over-year increase in RMG exports in FY 2021.

Over the previous five years, Bangladesh’s foreign exchange reserve increased at a compound annual growth rate of 8.6%, reaching 46.4 billion USD in FY 2020–21. However, the foreign reserve as of July 2022 had decreased to 39.49 billion USD. The prolonged conflict between Russia and Ukraine was the cause of both the sharp decline in inward remittances and the rising cost of imports. On the other hand, Bangladesh’s FDI in 2021 was 2.89 billion USD, rising at a CAGR of 7.6 percent in the last five years. The UK, Singapore, the Netherlands, and the United States have the largest total foreign direct investment (FDI) stock in main sectors as of March 2022.

The huge potential of Bangladesh

The Asian Development Bank (ADB), the World Bank, the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), the Asian Infrastructure Investment Bank (AIIB), the Agence Française de Développement (AFD), the European Union and the European Investment Bank (EIB), as part of Team Europe, the Green Climate Fund (GCF), the Government of South Korea, the Japan International Cooperation Agency (JICA), and the United Kingdom announced today a collaborative approach to support a package of measures for Bangladesh aimed at enhancing the nation’s ability to mitigate and adapt to the effects of climate change. This collaborative support will boost Bangladesh’s efforts to mitigate the impact of climate change on vulnerable people.

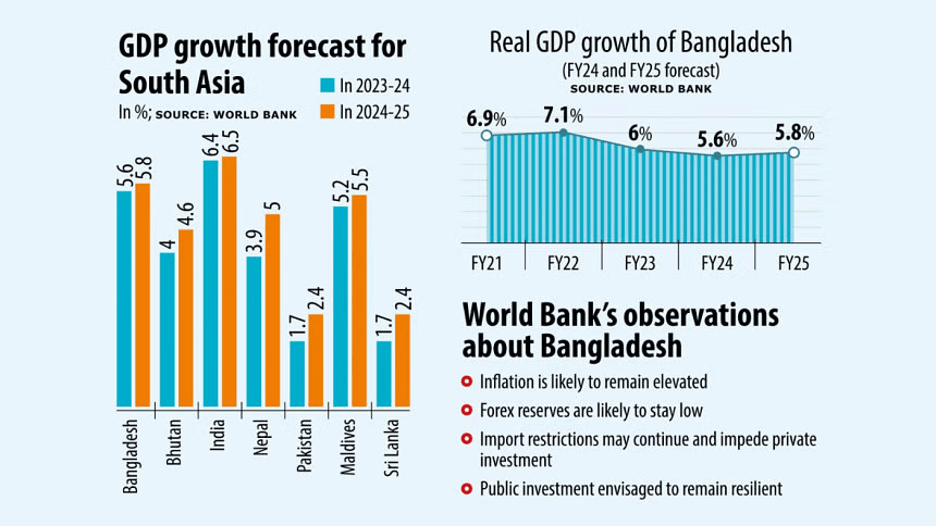

Because of ongoing economic pressure, Bangladesh is predicted to have the sixth-highest GDP growth in Asia this fiscal year—albeit below the government’s aim and its previous average. The country’s gross domestic product expansion is predicted to drop to 5.6 percent in 2023–24, unchanged from its October update, according to the World Bank’s Global Economic Prospects report released yesterday.

According to the World Investment Report 2022, foreign direct investment in Bangladesh reached a three-year high last year, allowing the country to maintain its ranking as the second most popular travel destination on the subcontinent, behind India.

According to the World Economic Forum’s (WEF) 2017–18 Global Competitiveness Index (GCI), Bangladesh has joined the elite group of the top 100 economies in the world.

UNCTAD noted regarding Bangladesh that the “Bangladesh Patents Bill 2022” expanded the period of patent protection from 16 to 20 years to boost FDI in 2022. This law may have influenced the rise in FDI inflows.

The “Bangladesh Patents Bill 2022” was passed to modernize the century-old patent legislation, draw in foreign investment, and safeguard intellectual property rights.

Also, UNCTAD applauded Bangladesh for pursuing sustainability measures. It stated that regulations requiring financial institutions and businesses to report on sustainability, including carbon emissions as a sustainability disclosure, were established by Bangladesh and a few other Asian nations, including China, Egypt, India, and Malaysia.

In comparison to other South Asian economies, Bangladesh has an attractive investment climate.

Key indications regarding Bangladesh’s investment climate are underlined below:

Bangladesh is a highly homogeneous society with no major internal or external problems, and its people are extremely resilient in the face of tragedy.

Also, Bangladesh is a liberal, democratic country. People in this land have lived in peace and harmony for thousands of years, regardless of their color or religion.

There is widespread nonpartisan political support for market-oriented reform and South Asia’s most investor-friendly regulatory system.

Trainable, eager, diligent, and low-cost (even by regional standards) worker force appropriate for any labor-intensive sector.

The country’s physical location is suitable for global trade, with highly quick access to international sea and air connections.

Bangladesh has a lot of natural gas and water, and its soil is quite productive.

Although Bangla is the official language, English is widely used as a second language.

Almost all developed countries allow goods from Bangladesh to enter duty-free and quota-free. Bangladesh’s foreign direct investment policy framework is the best in South Asia, further influencing this country’s global market access. Bangladeshi products enjoy 100% tariff and quota-free access to the EU, Canada, Australia, and Norway. Bangladeshi products have already gained access to lower-duty markets in Thailand, India, and Pakistan, albeit on a limited scale. However, talks with China, Russia, Malaysia, and other adjacent countries are underway. Bangladesh’s government formed:

- The Bangladesh Investment Development Authority (BIDA) promotes and facilitates private investment in the country.

- Bangladesh Hi-Tech Park Authority

- Bangabandhu Sheikh Mujib Shilpa Nagar (BSMSN)

By 2030, Bangladesh aims to create 100 Special Economic Zones (SEZs), comprising 30 Private Economic Zones and 70 Government Approved Economic Zones.

Bangladesh’s lucrative Export Processing Zones (EPZs) in Dhaka and Chittagong are augmented by fresh EPZ expansions and other substantial real estate investments statewide. The Bangladesh Export Processing Zones Authority (BEPZA) is the government’s official organization that promotes, recruits, and enables foreign investment inside these zones. The government of Bangladesh has identified several industries with great potential for foreign investment, including agribusiness, electronics, ceramics, foreign foods, apparel and textiles, ICT and business services, leather and leather goods, light engineering, power industry, and life sciences.

According to the non-discrimination principle, Bangladesh is generally welcoming to international investment, which allows for 100% foreign ownership in most sectors.

Local ownership is sometimes necessary, such as freight and cargo forwarding, airlines, railroads, general or pre-shipment services, shipping, courier services, buying house and indenting agents, advertising agencies, and for-profit or commercial educational institutions.

Written by: Tasnim Tarannum Progga

Edited by: Osman Gani Tuhin