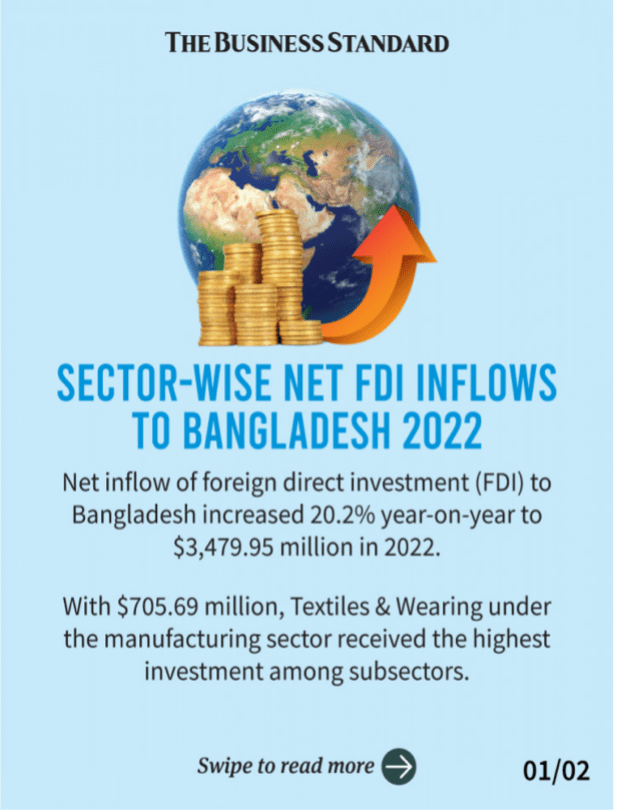

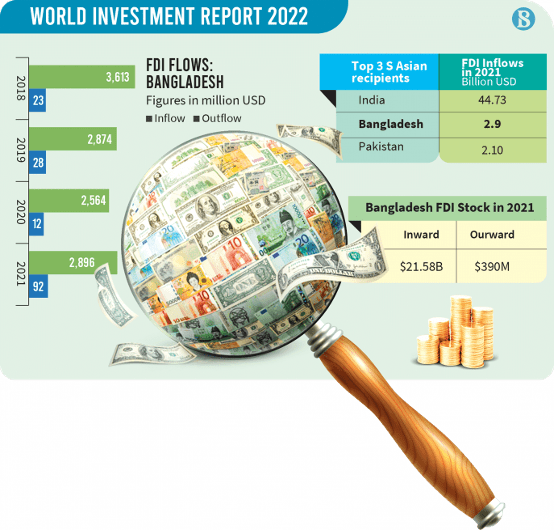

Foreign direct investment (FDI) has the potential to significantly contribute to Bangladesh’s economy’s development and help it achieve its socio-economic goals, including poverty reduction. Bangladesh FDI Data 2023 witnessed an impressive growth of 20.2% to $3.48 billion in 2022, as per Unctad’s World Investment Report 2023, marking the second-highest FDI inflow in the country’s history. This growth highlights Bangladesh’s ability to attract foreign investment, setting the stage for a brighter future.

The extension of patent protection duration from 16 to 20 years by the “Bangladesh Patents Act 2022” has significantly increased foreign direct investment in Bangladesh, as per UNCTAD. The Bangladesh government deserves appreciation for this move, which could have contributed to the rise in FDI inflows in the country. UNCTAD has praised Bangladesh and other Asian countries, including China, Egypt, India, and Malaysia, for taking sustainability measures. These countries have made it mandatory for companies and financial institutions to disclose sustainability metrics like carbon emissions, showing their commitment to sustainable development.

Access the most recent Bangladesh FDI Data 2023

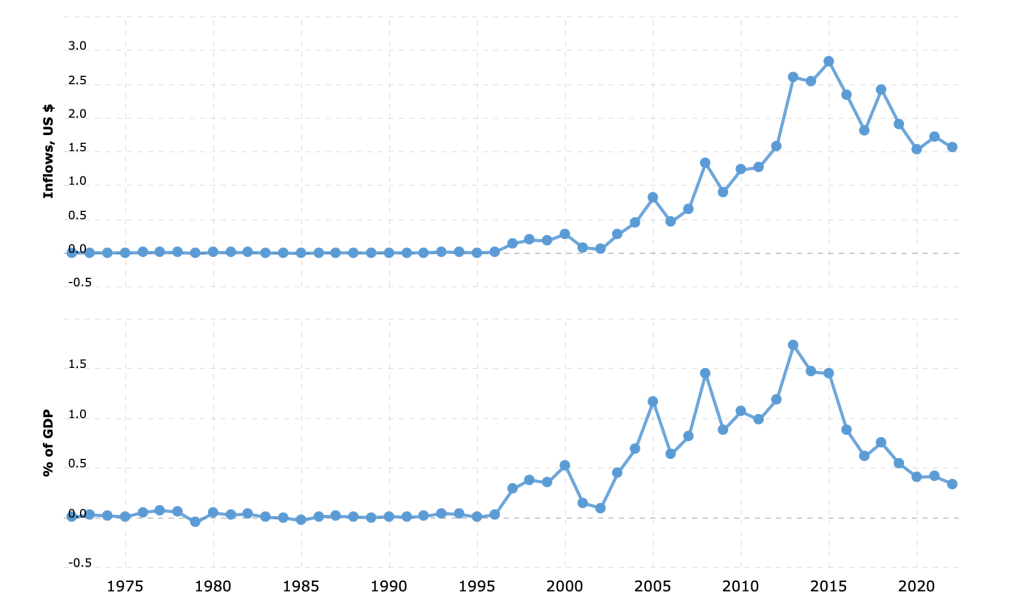

Foreign direct investment, as defined by the OECD, is the act of a resident entity in one economy acquiring a long-term interest in an enterprise in another economy. After gaining independence in 1971, Bangladesh relied mainly on foreign aid instead of foreign investment. However, the country’s status as an investment destination improved after financial sector reforms and financial liberalization in the 1990s. Consequently, the economic growth rate has remained relatively strong, at over 6 percent per annum, for the last two decades. Furthermore, FDI has grown at an average of 18.58 percent since 1997.

Bangladesh’s journey towards foreign direct investment has been remarkable. The country has come a long way despite starting with a meager US$ 0.090 million in 1972. With the government’s encouragement and policy incentives such as tax holidays, duty-free imports of capital machinery, 100% foreign ownership, and profit repatriation facilities, the country’s FDI inflow increased from US$ 308-356 million between 1980 and 1995. Today, sectors such as power generation, infrastructure development, private port establishment, joint venture with deep-sea port establishment under PPP, shipbuilding, ICT sector, call center, education, healthcare, mining, gas extraction, agro-processed products, electrical and electronics, light engineering, and fashion designing have tremendous potential to attract more FDI. It’s an inspiring journey demonstrating the power of determination and commitment towards progress and development.

Policy Shift Ignites FDI Boom!

Over the past ten years, a significant global trade and finance shift has resulted in a surge in foreign direct investment (FDI). Although a recent development, several underlying factors have contributed to the increase in FDI inflows in Bangladesh. These factors include liberalization of trade and exchange, current account convertibility, emphasis on private sector-led development, liberalization of the investment regime, opening up of infrastructure and services to the private sector – both domestic and foreign, and, most importantly, the interest of foreign investors in the energy and telecommunications sector. Studies suggest that more open trade policies are linked to foreign companies and economy-wide technological and productivity improvements in developing nations such as Bangladesh. Furthermore, there is evidence of a positive correlation between the increasing share of FDI in GDP and diversification towards high-tech exports in countries with open trade policies.

Bangladesh has implemented a highly effective Special Bonded Warehouse Scheme that enables firms to produce duty-free inputs exclusively for export and import. Additionally, a Duty Drawback System has been introduced to provide duty-free inputs or rebates on imported inputs for exporters. The Bangladesh Investment Development Authority (BIDA) was formed in 2016 by merging with the Board of Investment (BOI), established in 1989 to promote and facilitate private investment. The government has lifted capital and profit repatriation restrictions and opened almost all industries to foreign investment, resulting in an increased inflow of foreign capital.

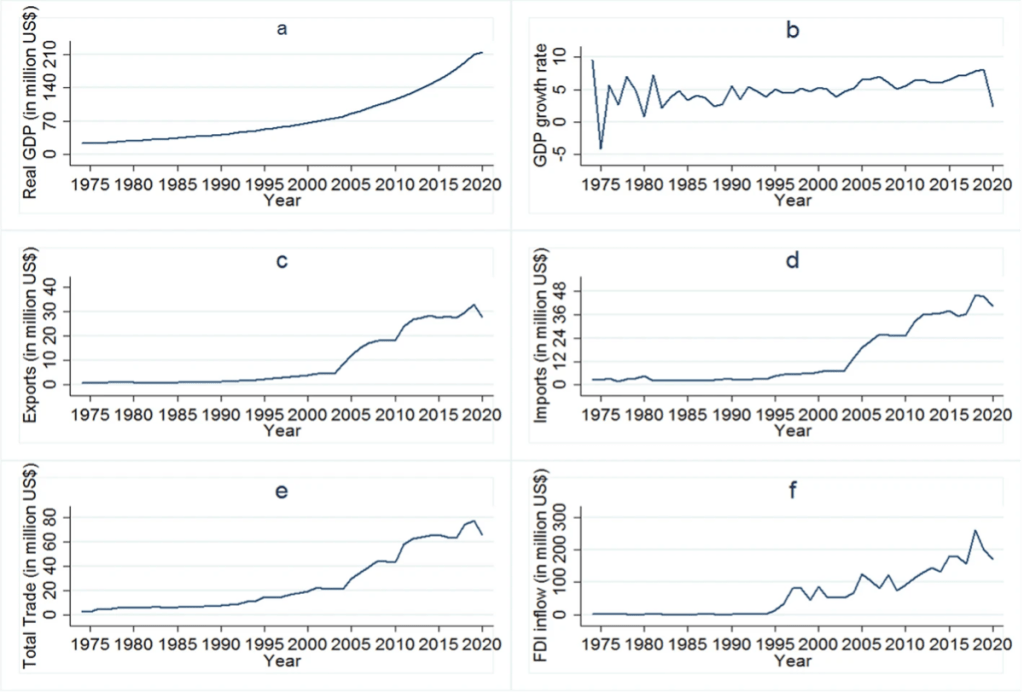

Time-series plots of real GDP and its growth rate, exports, imports, total trade, and FDI inflow (Bangladesh FDI Data 2023)

Real GDP has been steadily increasing since 2000, growing faster than before. Since 1990, the growth rate has been hovering around 5%, and it has been surpassing that rate since 2005. Although there was a decline in GDP growth after 2007, it went up again in 2010. Exports and imports were low before 2000, but both increased sharply in 2003, with a slight fluctuation. Total trade, which is the sum of exports and imports, followed the same trend as exports and imports. FDI inflow was insignificant before 1995. However, it started to rise after that due to the financial deregulation favoring liberalization.

Source: https://jfin-swufe.springeropen.com/articles/10.1186/s40854-023-00571-6/figures/1

As per Bangladesh’s 8th Five-Year Plan (FYP), achieving a consistently high pro-poor growth rate of over 8 percent is essential to attaining upper-middle-income status. Notably, Goldman Sachs has identified Bangladesh as one of the 11 emerging markets, and JP Morgan has identified it as one of the five frontier emerging economies.

Get insights into FDI inflows, outflows, and investment sectors (Bangladesh FDI Data 2023)

FDI inflows outflows of Bangladesh in Recent Years (Bangladesh FDI Data 2023)

Great news for Bangladesh! In 2022, the country witnessed a remarkable surge of 20.16 percent in foreign direct investment (FDI), hitting a whopping $3.48 billion. And that’s not all! According to the UNCTAD report, the USA, China, and Singapore were the top three nations worldwide that received the highest FDI influx, with an impressive $285 billion, $189 billion, and $141 billion, respectively.

Year Duration: From 2018-2022

Source: The World Bank Data

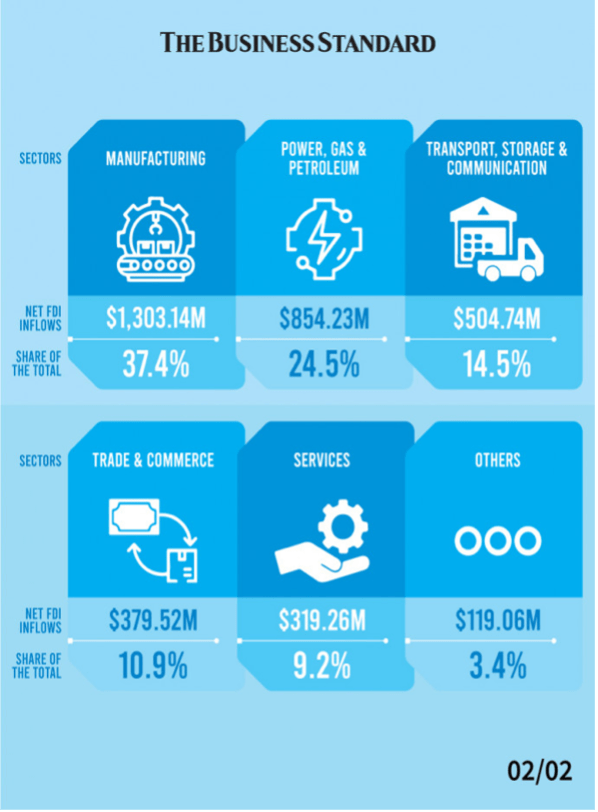

Sector-Wise Net FDI Inflows To Bangladesh in 2022

Source: The Business Standard

Threads of Success: Bangladesh’s Textile FDI Soars!

Bangladesh Bank recently released data showing that the Textile sector has received the highest Foreign Direct Investment (FDI) of US $ 1.229 billion. The data further reveals that South Korea stood at the top with US $ 435 million FDI, followed by Hong Kong with US $ 174 million, China with US $ 112 million, and India with US $ 54 million. The highest total FDI came from the United Kingdom with US $ 622 million, followed closely by South Korea with US $ 603 million. The Netherlands with US $ 512 million, Hong Kong with US $ 371 million, the United States with US $ 347.2 million, Singapore with US $ 330.62 million, and China with US $ 2.32 million have also significantly contributed to FDI.

According to domestic media reports, the energy sector has received US $ 340 million in foreign direct investment. The data suggests that the Netherlands provided US $ 111 million, and the United States provided US $ 202 million.

Trade-in Service (Bangladesh FDI Data 2023)

During the fiscal year 2022-23, there was an increase of US$ 130 million in the net deficit on the services account, resulting in a deficit of US$ 2,557 million. It is worth noting that there was a gradual improvement in credit for services related to transportation, telecommunication, ICT, and other business services over the preceding years. However, there was also a gradual rise in debit for services related to transportation, travel, and other business services, which contributed significantly to the account deficit.

Source: The Business Standard

The annual FDI inflow in Bangladesh has experienced significant growth, and the reasons behind this development are noteworthy. The recent enactment of the Bangladesh Patents Bills, 2022, which extended the duration of patent protection from 16 to 20 years, has played a pivotal role in attracting foreign investors to the country. Additionally, the adoption of sustainability measures has been another contributing factor. Bangladesh and other countries such as China, Egypt, India, and Malaysia have introduced measures that mandate financial institutions and companies to report on sustainability, including carbon emissions.

Source: Bangladesh Indicators

Sectors Expand: Bangladesh’s Investment Promise!

Bangladesh is a promising destination for foreign investors as it follows the non-discrimination principle and allows 100% foreign ownership in most sectors. While local ownership is required for specific cases, such as freight/cargo forwarding, shipping, or advertising agents, the government is committed to promoting private investment and competitive trade. With its long-term macroeconomic stability, high growth, and digital acceleration, Bangladesh is poised to become an upper-middle-income country by 2031 and a developed nation by 2041. Private consumption is booming, and by 2025, 34 million people will join the Middle and Affluent Class, presenting significant opportunities for growth in almost all sectors. The government’s target of a 46.88% gross investment-GDP ratio by FY 2041 requires private sector investment to reach 36.36% of GDP, which can be a win-win situation for investors and the country.

The National Industry Policy (NIP) (2022) designates the priority industries as follows:

Priority sectors:

- Overseas employment (human resources export),

- Environment-friendly ship recycling,

- Tourism,

- Home textiles,

- Windmill,

- Herbal medicine,

- Hospital and clinic,

- LED, CFL Bulb,

- Tea,

- Seeds,

- Cosmetics and toiletries,

- Cement,

- Logistics.

Special developing sectors:

- Electric & Electronic

- Ceramic

- Fish

- Printing & Packaging

- Jewelry

- Paper & Paper Products

- Rubber

- Resham

- Handcraft & Crafts

- Weaving

- Solar Energy

- Cashew Nuts (Raw & Processed)

- Crab (Raw & Processed)

- Toy

- Agar

- Halal Meat, Processed Meat Products & Other Halal Products

- Recycled Products

Blue Economy

The sustainable use of oceanic resources for economic growth, improving livelihoods, and promoting ocean ecosystem health constitutes the Blue Economy. The Bay of Bengal, located at the southern boundary of Bangladesh, has a rich oceanic trade history, contributing to a quarter of the world’s goods exchange. The government of Bangladesh plans to utilize its territorial waters as the new development space, with 26 potential sub-sectors within the Blue Economy, including fisheries, maritime trade, shipping, eco-tourism, and biotech, among others. These sub-sectors provide new investment opportunities amounting to US$ 16 billion. To exploit these opportunities, the government has developed the Bangladesh Delta Plan 2021 and introduced the Shipbuilding Development Policy 2020 to earn US$ 4 billion annually from ship export by 2025. Bangladesh pays almost US$ 9 billion annually in freight charges to foreign liners due to its limited number of ships. However, Bangladesh has over 300 local shipyards and is an industry leader in ship recycling. The country has untapped potential in deep-sea fishing, including aquaculture. Bangladesh only fishes within 60-70 kilometers of the 664 kilometers of sea area using trawlers and small boats. Other sub-sectors offer investment opportunities, including tourism, biotechnology, salt production, and renewable energy. Coastal tourism, in particular, represents a significant segment and can provide new avenues for growth and development.

Health & Pharmaceuticals

The healthcare industry is being made more accessible and affordable due to the pharmaceutical industry’s efforts. Bangladesh’s pharmaceutical companies meet almost all domestic demand and export their drugs to over 100 countries, including the USA, Europe, and Australia. The domestic market size of Bangladesh’s pharmaceutical industry is expected to reach $5 billion by 2024, and it is currently valued at $3 billion. Bangladeshi drug manufacturers possess expertise in diverse dosage delivery systems and are expanding their capabilities in bio-similars, vaccines, and oncology drugs. Over $1 billion has been invested in enhancing capacity, developing new facilities, and upgrading existing ones in the past five years. Many local companies have received major global GMP approvals and are improving their facilities to meet international standards. During the COVID-19 pandemic, Bangladesh gained worldwide attention by producing the world’s first generic versions of Molnupiravir and Remdesivir. Bangladesh is known for supplying quality generics at a low cost, and medicine prices in the country are among the most affordable in the world. The global market for generics is expected to grow from $400 billion to $600 billion by 2025, and several governments are promoting the use of generics. Bangladesh will likely benefit from expiring $166 billion of originator drugs in the next five years, creating new opportunities. The production of APIs is being promoted to reduce the industry’s reliance on imports, and API exports are incentivized. Bangladesh has a strong export potential for patented APIs due to the TRIPS waiver it currently enjoys. Bangladesh offers highly skilled professionals four to six times less expensive than those in India and China. The demand for improved healthcare services is growing due to Bangladesh’s increasing per capita income, and the number of private hospitals has increased fourfold in the last decade. Bangladesh imports most of its medical equipment, and there are opportunities to manufacture essential equipment. Investment in healthcare service provider training is another critical area that requires attention.

TRANSPORT, Infrastructure & LOGISTICS

Bangladesh aims to achieve double-digit GDP growth by attracting sufficient infrastructure investment in rail, road, port, power, energy, and logistics. To become an upper-middle-income country by 2031, the government needs to increase its Infrastructure Investment to GDP ratio from the current 3.6% to 6% to 7%, which requires an injection of US$ 300 billion. Bangladesh is considered the 14th most promising emerging logistics market in the world. It ranked 100th in the Logistic Performance Index Ranking and 38th in the Agility Emerging Market Index 2021. Over the last two decades, the country has experienced a 10.25% average annual export growth, and the government has set an $80 billion export target for the 2024 fiscal year. Bangladesh is also the world’s second-largest RMG exporter. Chattogram Port, the largest port in the country, handles 90% of cargo movement, and 82% of local cargo and container movement is carried out by road. Inland container depots or container freight stations handle an average of 50% of imports and exports. Over the last five years, the demand for warehousing has grown by 60-70%. Private investment is welcome in transportation and communication, warehousing, private inland container depots and container freight stations, tank terminals, aviation services, feeder vessels, coastal shipping transport industry, and ocean-going vessel business, among other logistics sub-sectors, including port, freight forwarding, e-commerce logistics, courier service, and C&F agent. The government has drafted the Private Inland Container Depots and Container Freight Station Policy 2021 to encourage private sector participation. Bangladesh is implementing a series of crucial infrastructure projects using the PPP model, with many more in the pipeline.

Agribusiness

There are various opportunities for investment in Bangladesh’s agriculture industry. These include research and development, agro-processing, seed, fertilizer, irrigation, farm mechanization, agri-communication, poultry, dairy, fisheries, jute, animal health, post-harvest, forward linkage, quality control, and certification. The agro-processing market is currently valued at US$ 3.5 billion, encompassing both domestic and export markets, and it is growing at an impressive rate of 8%. Similarly, the seed market, valued at US$ 500 million, is experiencing an annual growth of 6%, with 40% of traded seeds being imported. Additionally, the fertilizer market, presently worth US$ 1600 million, depends on imports.

It is important to note that the farm mechanization market is valued at US$1.35 billion, and it covers machines, spare parts, and services, with a subsidy of 50% to 70% readily available. Post-harvest loss can be up to 10% for grains and 40% for vegetables, while there is limited storage capacity for fish and milk. The export market for Bangladesh’s jute is valued at US$ 1.2 billion and is currently growing at a rate of 6.5%. On another note, the country has limited testing facilities for accreditation and certification, which means it depends on third countries.

LEATHER AND LEATHER GOODS

- Bangladesh has more than 40 million households, each with 4.06 people on average.

- Clothing and footwear spending accounts for 7.12% of total household consumption, approximately US$6.5 billion annually.

- Bangladesh’s health and fitness industry has grown tenfold since 2011, creating opportunities for the fitness apparel and footwear industry. As a result, big global brands are entering the Bangladeshi market and expanding their presence.

- The global footwear market is US$365on and is expected to increase to US$430US$430n by 2031. Bangladesh is the 8th largest footwear producer in volume and the 16th largest footwear exporter worldwide. Bangladesh’s footwear exports currently amount to US$1 biUS$1, but the goal is to reach US$5 bilUS$5

- Bangladesh is home to 1.7% of the world’s livestock, providing abundant raw materials for various industries. Despite setbacks due to COVID-19, the leather industry in Bangladesh has been driving sustainability initiatives, focusing on responsible sourcing, product life cycle, and waste management.

READYMADE GARMENTS & TEXTILES

Bangladesh is a leading manufacturer of readymade garments, with the second-largest production capacity in the world. The sector employs four million people and contributes to over 80% of the country’s export revenue and 11% of its GDP. It is worth noting that Bangladesh has a significant presence in the global garment industry, with 40 of the world’s top 100 factories located there. Additionally, Bangladesh has set an international benchmark with the highest number of green factories globally, with 150 LEED-certified factories and another 500 in the certification process.

Bangladeshi apparel is exported to 167 countries and enjoys duty-free access to the EU market. The European Union is the largest market for Bangladeshi garments, accounting for 61% of its total exports. As a Least Developed Country (LDC), 73% of Bangladeshi products, amounting to USD 25 billion, enjoy duty-free access.

Five core items account for 75% of Bangladesh’s exports, 74% being cotton-based and 80% priced within USD 15/kg. Bangladesh’s RMG businesses want to expand their market reach by entering markets in Latin America, the Russian Federation, Southeast Asia, South Africa, and the GCC. Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is partnering with Global Fashion Agenda to transition to a circular fashion system. Furthermore, investments in circular technology are accelerating.

ELECTRICAL, ELECTRONICS MANUFACTURING AND PLASTIC GOODS

Bangladesh’s thriving electronic and electrical equipment industry is a testament to the nation’s immense potential and the hard work of its people. This sector is vital to the country’s economy, with lately one million individuals employed in around 3,000 organizations, from mobile phones to air conditioners, electronic fans to ovens, and much more; the industry is continually expanding and providing innovative solutions to meet the needs of consumers and industries alike. With an estimated growth rate of 15% per annum, the industry could reach around US$ 12 billion by 2025. Similarly, the plastics sector, which employs around 1.2 million people and produces products for various industries, is also a significant contributor to the economy of Bangladesh. The domestic market size for plastic products is estimated to be over USD 2,500 million, while the direct export value of plastic goods is around USD 120 million. As the industry continues to grow and evolve, it is inspiring to see the people of Bangladesh driving change and creating opportunities for themselves and their communities.

What to consider if you invest in Bangladesh (Bangladesh FDI Data 2023):

The main assets of Bangladesh’s economy are:

- The International Monetary Fund (IMF) reported robust macroeconomic stability, with a growth rate of 8.2% in 2019 and 3.8% in 2020. AdditionaAccordingMF, the public debt was at a satisfactory level of 39.6% in 2020.

- An open, inclusive, and diverse economy

- A very low-cost workforce

- Investor welcome service (faster immigration)

- A strategic geographic position as a gateway to countries in the Asia-Pacific region

- Facilities, Tax Exemption, and Incentives for Foreign Investors in Bangladesh

- Competitive position in the value chain of the global value chain

- Global business-friendly policies.

- Utility connections facilitation.

- Favorable biodiversity and weather.

- Facilities, Tax Exemption, and Incentives for Foreign Investors in Bangladesh

Up-to-date statistics of Bangladesh FDI Data 2023

Rising Above: Bangladesh’s FDI Ascends to New Pinnacles

Bangladesh has achieved remarkable progress in attracting foreign direct investment (FDI). The country’s key sectors, including textile and apparel, gas and petroleum, power, banking, and telecommunications, have witnessed significant investments from countries like the USA, the UK, Singapore, Korea, Hong Kong, and China. In recent years, China emerged as Bangladesh’s most important foreign direct investment (FDI) source. Bangladesh’s commitment to creating a favorable business environment has paid off, with an increase in forex reserves at $20.03 billion as of January 17, 2024. The country’s remarkable progress in FDI inflows has placed it among the top five performers in the region, inspiring other countries to follow suit.

The report estimates that the country’s FDI stock is USD 21.1 billion, accounting for only a paltry 4.6% of its GDP. National Bank data indicates that in FY 2022-23, net FDI inflows amounted to USD 3.25 billion, USD 189.95 million, or 5.5% lower than FY 2021-22 but 29.6% higher than FY 2020-21.

– The European Union (EU) followed with USD 0.729 billion, an increase from USD 0.624 billion.

Finally, services attracted USD 0.243 billion or 7.5%, primarily from the other service sector, which contributed USD 0.186 billion or 5.7%.

Foreign Direct Investment (FDI) can be a crucial driver of economic growth in a developing country like Bangladesh. It can build physical infrastructure, generate job opportunities, and enhance the skills of local workers by transferring managerial expertise and technology. Additionally, FDI can facilitate the integration of the domestic economy with the global economy. Various sectors, such as power generation, infrastructure development, private port establishment, joint ventures with deep-sea port establishment under PPP, shipbuilding, ICT, call centers, education, healthcare, mining, gas extraction, agro-processed products, electrical and electronics, light engineering, and fashion designing, have the potential to attract more FDI. In Bangladesh, FDI has played a pivotal role in boosting its economy by increasing Gross Domestic Product (GDP), exports, domestic investment, and overall economic growth.

Written by: Tasnim Tarannum Progga

Edited by: Osman Gani Tuhin

2 thoughts on “Latest Bangladesh FDI Data 2023”

Nice to see you here with an excellent topic.

Thank you. Keep in touch!