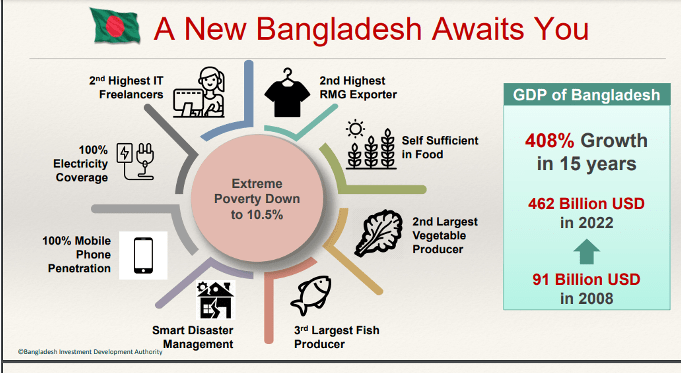

Foreign Direct Investment (FDI) is a powerful tool that can help boost Bangladesh’s economy and play a crucial role in achieving the country’s socio-economic objectives, including poverty reduction. Over the past decade, global financial and trade flows have undergone significant changes, with FDI experiencing a surge alongside other shifts. The country’s growth statistics are impressive, with an average of 7% GDP growth over the past few decades. Explore the historical trends of FDI trends in Bangladesh from 1972 to 2023. Learn about how FDI contributes to Bangladesh’s economy with this blog post.

Explore the historical FDI trends in Bangladesh from 1972 to 2023

In 1971, Bangladesh experienced a nationalist sentiment during the liberation war, which instilled a sense of freedom and dignity in its people. However, this also led to a cautious approach towards economic policy. During that time, policymakers were skeptical of foreign companies and discouraged foreign investment. From 1980 to 1995, Bangladesh’s FDI inflow increased from US$ 308-356 million, starting from a meager US$ 0.090 million in 1972.

However, this perception changed in the 1990s, and the government began encouraging foreign direct investment. They offered policy incentives, including tax holidays, duty-free imports of capital machinery, 100% foreign ownership, and profit repatriation facilities. Sectors such as power generation, infrastructure development, private port establishment, joint venture with deep-sea port establishment under PPP, shipbuilding, ICT sector, call center, education, healthcare, mining, gas extraction, agro-processed products, electrical and electronics, light engineering, and fashion designing have the potential to attract more FDI.

As outlined in the 8th Five-Year Plan (FYP), achieving a sustained high pro-poor growth rate (above 8 percent) is necessary for Bangladesh to reach upper-middle-income status.

Bangladesh is ranked as one of the following 11 emerging markets by Goldman Sachs and one of five frontier emerging economies by JP Morgan.

Cross-border investment entails a resident of one country exercising control or having significant influence over managing an enterprise in another country. This relationship is established when the individual owns 10 percent or more of the ordinary shares of voting stock. The presented data is denominated in current U.S. dollars.

Cross-border investment entails a resident of one country exercising control or having significant influence over managing an enterprise in another country. This relationship is established when the individual owns 10 percent or more of the ordinary shares of voting stock. The presented data is denominated in current U.S. dollars.

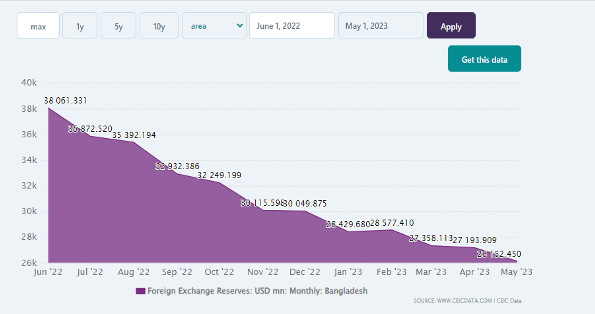

Bangladesh’s foreign direct investment decreased by 9.77% to $1.56B in 2022. It increased by 13.02% to $1.72B in 2021 but declined by 20.06% to $1.53B in 2020 and by 21.21% to $1.91B in 2019.

Bangladesh has undergone a remarkable transformation since gaining independence. It has shifted its economy from being primarily based on agriculture in rural areas to a more urbanized and industrialized one. 1981, agriculture contributed 35% to GDP while industry and construction contributed 14%, compared to 62% and 9%, respectively, in 1975. Dhaka, the capital city, grew from 2 million to 3.3 million during this period.

Learn about the factors influencing FDI trends in Bangladesh and how it contributes to the economy

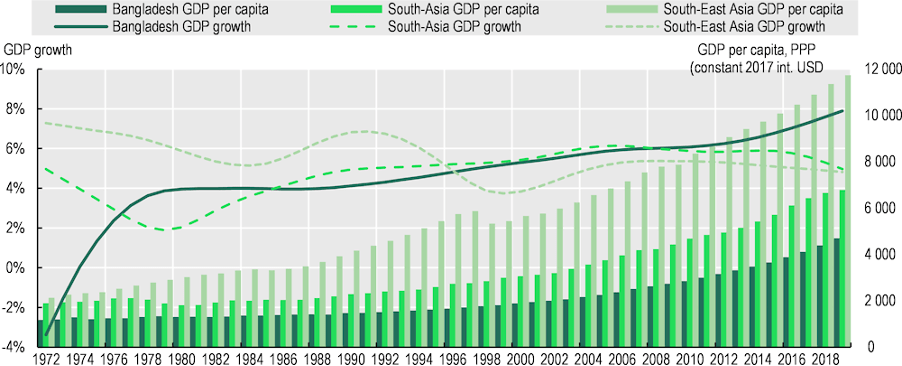

GDP Growth of Bangladesh

Note: South Asia excludes Bangladesh. Regional aggregates follow the UN classification. For GDP growth, an HP filter was applied (lambda 54.12), according to OECD guidelines, https://doi.org/10.1787/pdtvy-2016-en

Facilities and Incentives for Foreign Investors in Bangladesh

- 100% foreign equity is allowed for foreign direct investment with no restrictions on foreign equity participation.

- The government has provided a generous Tax Holiday for industries established in various zones – 5, 7, 9, and 12 years for developed, less developed, least developed, and special economic zones, respectively. The existing tax law allows extension units of an industry to be eligible for this incentive as well.

- Taxes do not apply to capital gains from the shares transfer through investing companies.

- Foreigners in Bangladesh can remit up to 50% of their salaries and have the facilities to repatriate their savings and retirement benefits when they return to their home country.

- Foreign nationals and employees involved in project-related work can obtain work permits without limitations.

- Investors can repatriate their profits, dividends, and invested capital.

- Foreign shareholders can transfer their shares to local investors.

- The reinvestment of remittable dividends will be considered a new investment.

- Foreign-owned companies that are registered in Bangladesh will be treated on an equal footing as locally-owned businesses.

- Royalties, technical know-how, and technical assistance fees are exempt from taxes, and there are facilities to repatriate them.

- Non-resident investors can invest in Bangladesh’s stock exchanges and get total working loans from local banks based on the bank-client relationship.

- Foreign technicians working for foreign companies are not subject to personal tax for a maximum of three years. If such technicians continue to work beyond this period, their individual income tax liability will depend on whether a double taxation avoidance agreement exists with their country of origin.

- Investors from foreign countries are permitted to retrieve their invested capital fully, and they are also allowed to transfer any profits and dividends earned from their investments.

- Foreign investors interested in investing in the country will receive “multiple entry visas,” valid for three years. Furthermore, experts coming to work in the country will be granted “multiple entry visas” that will remain valid for their work assignments.

- Tax exemptions apply to interests on foreign loans.

Opportunities in numerous industries nationwide are available for foreign investors to explore. However, specific sectors are restricted due to national security and environmental concerns. Such sectors comprise the manufacture of arms and ammunition, defence machinery and equipment, forest plantation, mechanized extraction from reserved forests, nuclear energy production, and security printing and mining.

Analyzing FDI trends in Bangladesh

- The country aims to become the 24th largest economy in the world by 2033, with a projected GDP of $460.8 billion in 2022 and a nominal GDP per capita of $2,470 in 2023.

- There has been a significant increase in clothing exports by 35.5%. This surge can be credited to the high demand for knitwear and woven garments. Additionally, the export orders from other significant countries have shifted towards this region. Engineering goods and leather and leather products have also made noteworthy progress.

- With an impressive acceleration from 19.7% to 35.9%, imports soared to a staggering $82.5 billion in value.

- The import of construction intermediate goods, fertilizer, and pharmaceuticals has witnessed an incredible increase of 63.5%.

- There was a significant increase of 26.3% in the imports of capital goods, which indicates that businesses are highly confident. The remarkable growth of 26.3% in the imports of capital goods is a clear indication of the unwavering confidence that companies possess.

Rising demand for exports and higher prices have significantly driven up imports of intermediates used in garment manufacturing, accounting for approximately one-third of the increase.

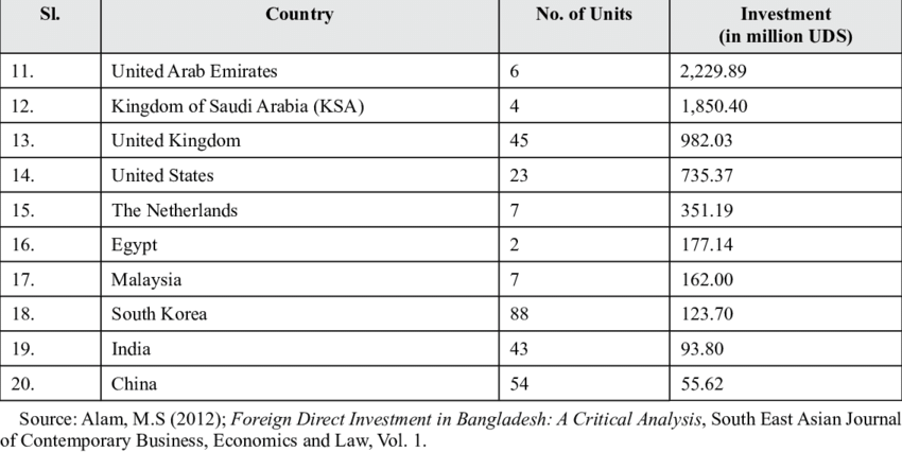

Countries invested in Bangladesh:

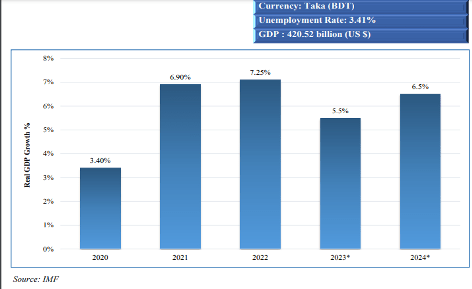

Given the ongoing global economic crisis and Russian aggression towards Ukraine, the International Monetary Fund (IMF) has projected Bangladesh’s growth forecast for FY 2023. The IMF projects that the country’s GDP will grow 5.50 percent in FY 2023, 1.6 percentage points lower than projected in October 2022.

Bangladesh’s economy has been on fire for the past decade, with an impressive high growth rate that hit the 7.0 percent milestone in FY 2015-16 and the 8.0 percent mark in FY 2018-19. Of course, the COVID-19 pandemic took a toll, and we saw a dip in the growth rate, which fell to 3.45 percent in FY 2019-20. But fortunately, the economy has been bouncing back and growing by 6.94 percent in FY 2020-21. According to the provisional estimates provided by the Bangladesh Bureau of Statistics (BBS), The GDP has reached an impressive growth rate of 7.25 percent, exceeding the previous fiscal year’s rate by 0.31 percentage points and the target rate by 0.05 percentage points. The per capita national income and GDP for FY 2021-22 have also shown a significant improvement compared to the previous year, with US$ 2,824 and US$ 2,723, respectively. The official estimate for Bangladesh’s GDP was $1.131 trillion at the end of 2023 in purchasing power parity terms.

Despite the International Monetary Fund’s projection of a 5.50 percent GDP growth rate for Bangladesh in FY 2023, the country surpasses expectations by achieving an impressive 6.3 percent growth rate. Projections for the GDP growth rates are optimistic, with expected growth rates of 7.5 percent, 7.8 percent, and 8.0 percent for FY 2022-23, FY 2023-24, and FY 2024-25, respectively, which implies a brighter future for our economy.

The remarkable growth of RMG and related activities have fueled the country’s industrialization process. The government has unequivocally established itself as the epicenter of mass-market production, from trendy knit t-shirts to stylish non-knit men’s suits and shirts and cozy sweaters. Resulting in a significant increase in manufacturing value added as a percentage of GDP, rising from 11% in 2000 to a staggering 22% in 2022. This progress puts Bangladesh ahead of other emerging countries such as India and Indonesia and aligns it with other top manufacturing hubs like Turkey, Vietnam, and Thailand.

Investment Catalyst: Jute, Agriculture, Auto, Machinery, Leather Industries Soar!

The textile and jute industries are the backbone of Bangladesh’s economic growth, playing a vital role in industrialization, generating employment opportunities, and contributing to export earnings. Notably, the textile sector received the highest foreign direct investment (FDI) of $1,229 million in the fiscal year 2023, making it a testament to the world-class potential and opportunities that Bangladesh offers. The country has also allowed a 15% cash incentive on leather product exports for the next five years, with scope for producing and exporting wet blue leather by establishing appropriate industries. Non-leather shoe and bag exporters can now receive an additional four percent cash incentive, in addition to the existing 15%, for exporting their products to the Euro region from July 2019. This benefit applies to those exporters who import raw materials under the duty draw-back or bonded warehouse facilities. Bangladesh’s exports enjoy duty-free access as LDC, with 73% of the country’s exports eligible for this benefit. The domestic pharmaceutical market in Bangladesh is expected to reach US$5 billion by 2024.

The jute sector contributes 4.9% to Bangladesh’s total national export earnings, with the loom industry’s value addition of more than 1,227.00 crores. The jute industry presents excellent opportunities for foreign direct investment, including in packaging materials, home decor and furnishings, and jute-technical products such as agrotech, build tech, clothes, and geotextiles.

Source: Diversified Jute Products.

The vibrant industrial sector in the country

The government of the country has given priority to the vibrant industrial sector. They have formulated the National Industry Policy 2010 to increase the industrial sector’s share of GDP from 30% to 40% by 2021. The policy focuses on modernizing and diversifying economic activities, improving infrastructure, enhancing productivity, and promoting SMEs. The government has taken decisive measures to progressively enhance the country’s competitiveness in the industrial sector in line with those policies. With the implementation of these initiatives, we have achieved substantial and consistent growth in both GDP and export earnings year after year.

Source:Invest in Emerging Bangladesh

Stable and Secured Business Environment

Bangladesh is a society where people of different races and religions live peacefully and harmoniously. This peaceful environment has led to stability in the country. The major political parties in Bangladesh are in agreement on policies related to private investment. The legal and policy framework in the country has been consistent for many years, with ongoing efforts to improve the overall investment climate further.

Commercial ventures are finding Bangladesh to be a location of high competitiveness. Bangladesh is an exceptionally competitive location for commercial ventures, offering advantages such as low costs, availability of resources, a large domestic market, access to international markets, streamlined trade processes, consistent policies for investment protection, and socio-political stability. Last year, our country’s foreign direct investment (FDI) inflow rose by an inspiring 24% yearly, reaching $1.83 billion. This signifies a continuous growth in inbound FDI, which is a hopeful sign for our economy.

Other Facilities in Bangladesh for FDI

Bangladesh has a lot going for it. Its excellent connectivity is a significant advantage, and the country is well-positioned to take advantage of a rapidly growing domestic market.

To conclude, with privileged access to the international market and a supportive business environment, Bangladesh is an inspiring place to do business. Moreover, the highly competitive cost structures further enhance the country’s appeal. This unique combination of factors makes it possible for investors to achieve the best returns on their investments in Bangladesh.

Written by: Tasnim Tarannum Progga

Edited by: Osman Gani Tuhin