Bangladesh has become an attractive destination for foreign investors in recent years, immense thanks to the country’s successful implementation of special economic zones (SEZs). These designated areas offer a range of benefits to investors, including tax breaks, streamlined regulations, and improved infrastructure. As a result, Bangladesh has seen a significant increase in foreign direct investment (FDI) in recent years, with many investors choosing to establish their operations within the SEZs. In this article, we will delve into why SEZs in Bangladesh are so effective at luring foreign direct investment, examining the various factors contributing to their success and exploring their impact on the country’s economy. Whether the investor is looking to explore new opportunities or is simply interested in the economic development of Bangladesh, this article provides valuable insights into the benefits of SEZs and their potential for future growth.

Introduction

In its first 50 years of independence, Bangladesh has made significant progress. Since its independence, Bangladesh has experienced remarkable economic growth and social progress, steadily reducing poverty and enhancing living conditions. This extended period of steady economic development failed by the COVID-19 pandemic, which exacerbated some prior vulnerabilities. Continued challenges include stagnant employment growth, growing inequality, sluggish poverty reduction: low revenues, and persistently significant financial sector vulnerabilities. To reach upper-middle income status by 2031, significant investments in infrastructure, human capital, and climate resilience are necessary.

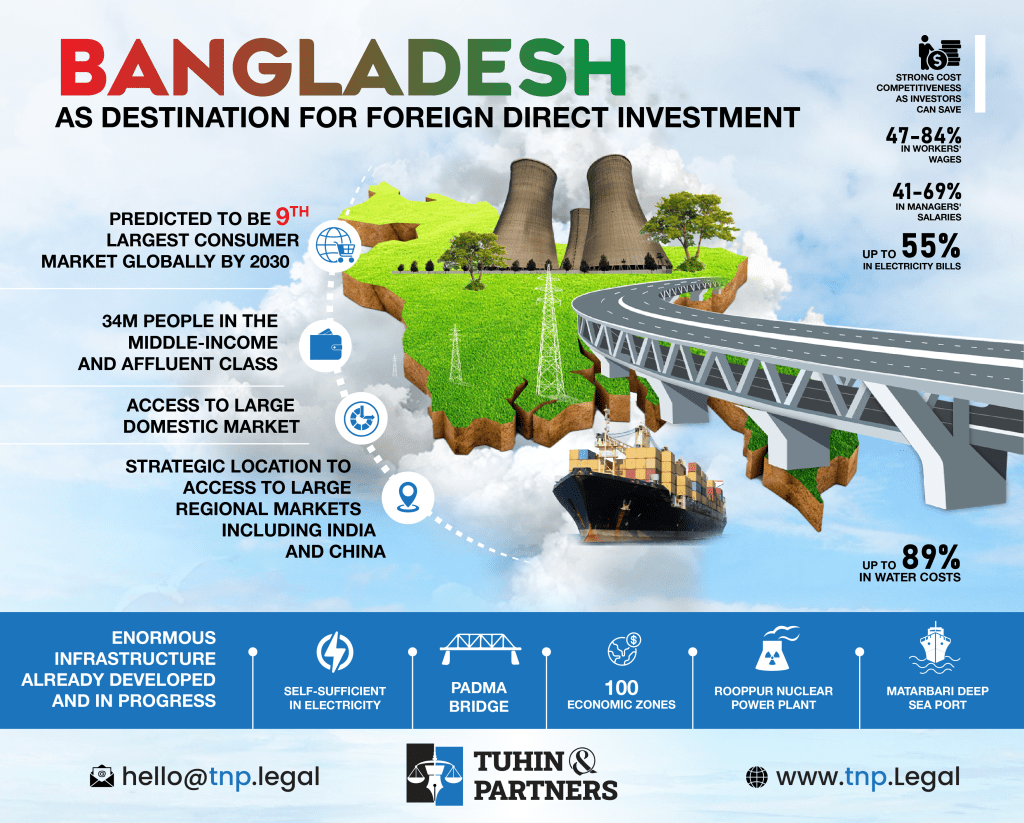

Bangladesh as a Destination for foreign direct investment (FDI)

In Bangladesh, manufacturing and service sector activities rebound led to solid growth in FY21 and the first half of FY22. Over the next few years, GDP growth is likely to stay strong. Headline inflation rose to 6.2 percent in February 2022, driven by food and non-food prices. The war in Ukraine and associated sanctions may lead to a higher current account deficit and rising inflation as global commodity prices surge. Public debt remains sustainable, and the March 2022 joint World Bank-IMF Debt Sustainability Analysis assessed that Bangladesh remained at low risk of external and public debt distress.

Bangladesh is one of the top investment destinations for many foreign investors due to its low wages, competitive production costs, training resources, energy availability, and sizable domestic market. In 2022, Bangladesh’s gross national product climbed to 31520.93 BDT billion from 12821.19 BDT billion in 2021.

In its World Investment Report for 2022, UNCTAD reports that FDI in Bangladesh increased by 13 percent to $2.9 billion in 2021. In 2020, the JETRO Survey on Business Conditions of Japanese Companies Operating Overseas (Asia and Oceania) will demonstrate the favorable impact of reforms in Bangladesh’s trading environment.

Bangladesh is creating immense economic opportunities. Nearly 60 percent of the population is economically active, and almost one million graduates enter the workforce each year.

Furthermore, Bangladesh’s geostrategic proximity to China and India lends credence to the claim that the nation’s economy will advance in the future. Bangladesh’s installed capacity currently stands at 25,514 MW as of March 2022, and the government is importing LPG and LNG through private initiatives. Bangladesh has already achieved lower-middle-income status and aims to achieve middle-income status by 2021 and developed nation status by 2041.

What exactly is a Special Economic Zone?

The Bangladesh Economic Zones Authority (BEZA) has taken initiatives to establish 100 Special Economic Zones (EZ) on 30,000 hectares of land to generate ten million laborers and sustainable industrialization to expand and diversify the industries. EZ are industrial parks/zones that will foster the growth of domestic and foreign sectors. Public-private partnership, private, and government ownership models construct EZ. Investors can lease land or industrial spaces at a competitive rate within EZ. The government offers numerous financial incentives to investors who intend to establish factories and plants in the Economic Zones. Due to close government ties and sponsorship, these Economic Zones will be hassle-free preferred locations for foreign investors wishing to develop factories and plants in Bangladesh.

Diverse Fiscal Incentives in Special Economic Zones for foreign direct investment (FDI)

BEZA would provide a variety of incentives, not just to the people who developed Economic Zones but also to those who invested in industrial units. The zone developer may reap benefits such as increased income tax exemptions and decreased capital expenditures. The incentive system for investment includes tax exemptions, exemptions from customs and excise charges, and non-financial benefits, such as having no limit on foreign direct investment, issuing work permits, and recommending residents for citizenship or resident ship.

| SL No. | Incentives | Explanation | Gazettes |

| 01 | Exemption from paying income tax varies over 12 years, including the complete exemption for the first ten years. | 1st 10 years – 100% 11th year – 70% 12th year – 30% | SRO No 227-Law/Income Tax/2015 Date: 08 July 2015 of Internal Resources Division |

| 02 | Income tax exemption on dividends for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 03 | Income tax exemption on capital gains from transfer of shares for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 04 | Income tax exemption on royalties, technical know-how, technical assistance fees, Etc for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 05 | Duty-free import of goods to be used for the development of Zones (except for MS Rod/Bar, Cement, Pre-fabricated Building, Iron/Steel Sheet) | 100% Exemption | SRO No 208- Law/2015/45/Customs Date: 1 July 2015 of Internal Resources Division |

| 06 | Land development tax exemption | 100% Exemption | SRO No. 05-Law/2016 Date: 11 Jan 2016 of Ministry of Land |

| 07 | Exemption from tax sub tax, rate, toll, fees Etc, imposed under section 65 of Local Government (Union Parishad) Act, 2009 | 100% Exemption | SRO No. 333-Law/2015 Date: 12 Nov 2015 of Local Government Division |

| 08 | Exemption from tax on transferring immovable property imposed under section 44 of the Upazilla Parishad Act, 1998 | 100% Exemption | SRO No. 328-Law/2018 Date: 11 Nov 2018 of Local Government Division |

| 09 | Exemption of Stamp Duty on registration of loan document with Scheduled Bank | 100% Exemption | SRO No. 7-LW/2016 Date: 12 January 2016 of Internal Resources Division |

| 10 | Stamp duty is exempted when transferring land in favor of the Consortium, Joint Venture (Private EZ developers) formed to set up the zone. | 100% Exemption | SRO No. 287-Law/2017/08.00.0000.040.22.005.15 Date: 21 Sep 2017 of Internal Resources Division |

| 11 | Income Tax deducted at source (under section 53H of the Income Tax Ordinance 1984) is exempted when transferring land in favor of the Consortium, Joint Venture (Private EZ developers) formed to set up the zone. | 100% Exemption | SRO No. 120-Law/Income Tax/2018 Date: 26 Apr 2018 of Internal Resources Division |

| 12 | Registration fees (Registration Act 1908) are exempted when transferring land in favor of the Consortium, Joint Venture (Private EZ developers) formed to set up the zone. | 100% Exemption | Circular No. R-6/1M-11/2017-269 Date: 19 Sep, 2017 |

| 13 | The land leasing contract between BEZA and Developers is exempt from paying stamp duty. | 100% Exemption | SRO No. 07-Law/2016 Date: 12 Jan 2016 of Internal Resources Division |

| 14 | Exemption from the stamp fee is generally associated with the registration of a lease. | 50% Exemption | SRO No. 06-Law/2016 Date: 12 Jan 2016 of Internal Resources Division |

| 15 | EZ investors are waived from the Board of Investment Act of 1989 | Completely Exempted | SRO No. 108-Law/2016 Date: 21 April 2016 of Prime Minister’s Office |

| SL No. | Incentives | Explanation | Gazettes |

| 01 | Income Tax exemption for 10 years (except edible oil, sugar, flour, cement, iron, and iron-related products) | Extent -100% (for 1st, 2nd , 3rd year) 4th year – 80% 5th year – 70% 6th year – 60% 7th year – 50% 8th year – 40% 9th year – 30% 10th year – 20% | SRO No 104-Law/Income Tax/2020 Date: 25 March 2020 of Internal Resources Division |

| 02 | Income tax exemption on dividends for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 03 | Income tax exemption on capital gains from transfer of shares for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 04 | Income tax exemption on royalties, technical know-how, technical assistance fees, Etc, for ten years | 100% Exemption | SRO No 299/Law/Income Tax/2105 Date: 8 Oct 2015 of Internal Resources Division |

| 05 | Exemption from Income Tax on the income of expatriate for three years | 50% Exemption | SRO No. 298- Law/Income Tax/2015 Date: 8 Oct 2015 of Internal Resources Division |

| 06 | Exemption from double taxation subject to the existence of a double taxation agreement | subject to the double taxation agreement | National Board of Revenue |

| 07 | Duty-free import of capital machinery and construction material (except for MS Rod/Bar, Cement, Pre-fabricated Building, Iron/Steel Sheet) | 100% Exemption | SRO No 209- Law/2015/46/Customs Date: 1 July 2015 of Internal Resources Division List of capital types of machinery SRO No. 121- Law/2020/72/Customs Date: 3 June 2020 of Internal Resources Division |

| 08 | Warehousing Station | Entire EZ has been declared as warehousing station. | SRO No 211/Law/2015/48/Customs Date:1 July 2015 of Internal Resources Division Amendment: SRO No 203/Law/2017/48/Customs Date: 20 June 2017 of Internal Resources Division |

| 09 | Home Consumption & Other Bond Facilities, Warehouse Operator | All the unit investors in EZs are entitled to this facility. | 1. SRO No 211/Law/2015/48/Customs Date: 1 July 2015 of Internal Resources Division Amendment: SRO No 203/Law/2017/48/Customs Date: 20 June 2017 of Internal Resources Division 2. SRO No 181/Law/2008/2209/Customs Date: 26 June 2008 of National Board of Revenue Amendment: SRO No. 203-Law/2017/48/Customs Date: 20 June 2017 of National Board of Revenue Amendment: SRO No. 136-Law/2020/87/Customs Date: 03 June 2020 of National Board of Revenue Amendment: SRO No. 194-Law/2020/104/Customs Date: 30 June 2020 of National Board of Revenue 3. Notification No. 42/2017/Customs/199 Date: 2 May 2017 of National Board of Revenue Amendment: 288/2017/Customs/529 Date: 21 Dec 2017 of National Board of Revenue Amendment: 195/2018/Customs/197 Date: 6 May 2018 of National Board of Revenue |

| 10 | Dedicated Customs Procedure (Economic Zone) | All the industries in EZs are eligible. | Notification No. 42/2017/Customs/199 Date: 2 May 2017 of National Board of Revenue Amendment: 288/2017/Customs/529 Date: 21 Dec 2017 of National Board of Revenue Amendment: 195/2018/Customs/197 Date: 6 May 2018 of National Board of Revenue |

| 11 | 20% sale of the finished product to the Domestic Tariff Area (DTA) | 20% of the export volume of the last fiscal year | Notification No. 42/2017/Customs/199 Date: 2 May 2017 of National Board of Revenue Amendment: 288/2017/Customs/529 Date: 21 Dec 2017 of National Board of Revenue Amendment: 195/2018/Customs/197 Date: 6 May 2018 of National Board of Revenue |

| 12 | Sub-contracting with Domestic Tariff Area (DTA) allowed | 100% Allowed | Notification No. 42/2017/Customs/199 Date: 2 May 2017 of National Board of Revenue Amendment: 288/2017/Customs/529 Date: 21 Dec 2017 of National Board of Revenue Amendment: 195/2018/Customs/197 Date: 6 May 2018 of National Board of Revenue |

| 13 | Exemption of Customs Duties, Regulatory Duty, VAT, and Supplementary Duty for import of vehicles (up to 2000 cc, one sedan car and one microbus/pick up van/ double cabin pick up) | 100% Exemption | SRO No. 210- Law/2015/47/Customs Date: 1 July 2015 of Internal Resources Division Amendment: SRO No. 312- Law/2015/57/Customs Date: 28 Oct 2015 of Internal Resources Division |

| 14 | Duty exemption on export | 100% Exemption | 1st Schedule of The Customs Act, 1969 |

| 15 | Exemption from VAT on Utility services related to the production of goods | 100% Exemption | SRO No. 190-Law/2019/47-VAT Date: 13 June 2019 of Internal Resources division |

| 16 | Land development tax exemption | 100% Exemption | SRO No. 05-Law/2016 Date: 11 Jan 2016 of Ministry of Land |

| 17 | Exemption of stamp duty on lease registration | 50% Exemption | SRO No. 06-Law/2016 Date: 12 Jan 2016 of Internal Resources division |

| 18 | Exemption from tax sub tax, rate, toll, fees, Etc, imposed under section 65 of Local Government (Union Parishad) Act, 2009 | 100% Exemption | SRO No. 333-Law/2015 Date: 12 Nov 2015 of Local Government Division |

| 19 | Exemption from tax on transferring immovable property imposed under section 44 of the Upazilla Parishad Act, 1998 | 100% Exemption | SRO No. 328-Law/2018 Date: 11 Nov 2018 of Local Government Division |

| 20 | EZ investors are waived from the Board of Investment Act of 1989 | Completely Exempted | SRO No. 108-Law/2016 Date: 21 April 2016 of Prime Minister’s Office |

| 21 | Framework for the regulation of businesses operating inside EZs that engage in foreign currency transactions | Completely | FE Circular No. 21 of 11 May 2017 incorporated in chapter 20 of the Guidelines for Foreign Exchange Transactions-2018 (GFET), Vol-1 of Bangladesh Bank |

| 22 | Foreign investment in Bangladesh, including EZs | No restrictions except few sectors | As per appendix-6 of Industrial Policy-2022 |

| 23 | Ceiling of FDI | No ceiling of foreign contents | 1. Industrial Policy- 2022 of Ministry of Industries 2. FE Circular No. 21/2017 of Bangladesh Bank |

| 24 | Repatriation of dividend earned against the investment | 100% | 1. No permission from Bangladesh Bank (paragraph 31, chapter 10 of GFET, paragraph 9 of FE Circular No. 21/2017, and paragraph 9, chapter 20 of GFET by Bangladesh Bank) 2. Dividends can be credited to foreign currency accounts maintained by foreign investors in Bangladesh (FE Circular No. 26 of 7 July 2020 of Bangladesh Bank) |

| 25 | Repatriation of sales proceeds of investment | 100% | 1. Detailed instructions outlined at FEID Circular No. 01 of 6 May 2018 of Bangladesh Bank 2. Relaxation vide FEID Circular Letter 01 of 18 June 2020 of Bangladesh Bank in the following counts: a) No approval from Bangladesh Bank is needed for remitting share sales proceeds, regardless of quantity. Fair value is assessed using the net asset value technique based on the latest audited financial statements, and the financial statements include no revalued assets. b) Bangladesh Bank requires no permission to repatriate sales proceeds of shares up to Tk 10.00 million without valuation reports. c) Sales proceeds exceeding Tk 10 million up to Tk 100 million may be remitted abroad based on the fair value determined based on appropriate valuation methods. Repatriation of sales proceeds of investment. |

| 26 | Loan from external sources | 100% | Paragraph 8 of FE Circular No. 21/2017 and paragraph 8, chapter 20 of GFET of Bangladesh Bank |

| 27 | Repatriation of Royalty, Technical Know-how & Technical Assistance Fees | 1. For the new project, they are at most 6% of the cost of the imported machinery. 2. For ongoing concerns, they were not exceeding 6% of the previous year’s sales as declared in the income tax return. | Paragraph 11 of FE Circular No. 21/2017 and paragraph 11, chapter 20 of GFET of Bangladesh Bank |

| 28 | Telephonic Transfer (TT) | No limit | Paragraph 7 of FE Circular No. 21/2017 of Bangladesh Bank |

| 29 | FC Accounts for EZ enterprises | Extent – Full | Paragraph 4 of FE Circular No. 21/2017 and paragraph 4, chapter 20 of GFET of Bangladesh Bank |

| 30 | FC Accounts for foreign nationals working in EZ enterprises | Extent – Full | Paragraph 1, chapter 13 of GFET of Bangladesh Bank |

| 31 | Remitting income of foreign nationals working in EZs | 75 % of current income | 1. Paragraph 12 of FE Circular No. 21/2017 and paragraph 12, chapter 20 of GFET of Bangladesh Bank 2. FE Circular No. 24 of 23 June 2020 of Bangladesh Bank |

| 32 | Industries operating in the Domestic Processing Area (DPA) of EZs can meet their foreign payment obligation on Royalty, Technical Know-how& Technical Assistance Fees from their Taka Account. | FE Circular No. 41 of 04 October 2020 | |

| 33 | Market exploration assistance for Type C industries operating in EZs against the export of 1. Sandals and bags made of synthetic & fabrics 2. Agro-processing goods | 4% Cash Incentive on the condition of minimum value addition of 30% | Paragraph 9 of FE Circular No. 35, dated 22 September 2019 of Bangladesh Bank |

| 34 | Backward Linkages of raw materials to sell for export-oriented industries | 100% | Paragraph 06 of FE Circular No. 21/2017 of Bangladesh Bank |

| 35 | Formation of Joint Venture Industries | FE Circular No. 21/2017 of Bangladesh Bank | |

| 36 | Special cash incentives against the export of textile goods, including ready-made garments | FE Circular No. 01, dated 07 January 2020 of Bangladesh Bank | |

| 37 | Issuance of work permits to foreigners is allowed. | Up to 5% of total officers/employees of an industrial unit | Notification No. 03.068.004.09.00.00.016.2018-664 (7 Nov,2018) |

| 38 | Permanent Resident | For investment of USD$ 200,000 or above | Industrial Policy- 2022 of Ministry of Industries |

| 39 | Citizenship | For investment of at-least USD$ 1,000,000 or transfer at-least USD$ 2,000,000 to any recognized financial institute. | Industrial Policy- 2022 of Ministry of Industries |

| 40 | No Visa Required (NVR) | For investment of USD$ 10,000,000 or above in any heavy or long term industry. | Industrial Policy- 2022 of Ministry of Industries |

Conclusion

Bangladesh is a popular place to relocate labor-intensive industries. The government has implemented several policies to create a more open and competitive environment for foreign and domestic private investment. The government encourages rapid economic growth by expanding and diversifying industries, employment, production, and export. The Special Economic Zones offer foreign investors a secure, financially attractive, and convenient environment. The incentives and services provided in the EZs are pretty enough to attract the attention of foreign investors with the right mindset who are willing to relocate to or establish a new business in Bangladesh.

In conclusion, special economic zones (SEZs) have proven to be a successful strategy for attracting foreign direct investment (FDI) to Bangladesh. With tax incentives, streamlined regulations, and improved infrastructure, SEZs offer a range of benefits to investors that make Bangladesh an attractive destination for FDI. As a result, the country has seen a significant increase in FDI in recent years, with many investors establishing their operations within the SEZs. The impact of these zones on the economy has been significant, and their potential for future growth remains high. For those interested in investing in Bangladesh or learning more about the country’s economic development, SEZs and their effectiveness in luring FDI are certainly worth exploring.

2 thoughts on “How do Bangladesh’s SEZs really lure Foreign Direct Investment (FDI)?”

Excellent post. I was checking continuously this weblog and I’m

impressed! Extremely useful info particularly the last part 🙂 I care for such information much.

I was looking for this certain info for a very long time.

Thanks and good luck.

Thanks for your kind words