RJSC Return Filing is one of the most critical compliance obligations for companies, partnerships, and registered entities in Bangladesh. The Registrar of Joint Stock Companies and Firms (RJSC) is the authority that oversees corporate filings and ensures that all entities operate under the Companies Act 1994 and other applicable laws.

Timely RJSC Return Filing not only avoids legal penalties but also strengthens transparency, credibility, and governance within a business. This article provides a detailed overview of the RJSC Return Filing process in Bangladesh, its types, required documents, deadlines, and compliance guidelines.

What is RJSC Return Filing?

RJSC Return Filing refers to the statutory submission of reports, documents, and forms to the RJSC by companies and registered entities. These filings confirm the company’s structure, financial performance, director/shareholder information, and any changes in corporate affairs.

It ensures:

-

Legal compliance with corporate regulations.

-

Transparency for shareholders and investors.

-

Smooth operation of banking, investment, and contractual relationships.

Types of RJSC Return Filing in Bangladesh

Different types of returns must be filed depending on the company’s activities and changes in its corporate structure.

1. Annual RJSC Return Filing

Every company must file an Annual Return after holding its Annual General Meeting (AGM). This return discloses:

-

List of directors, shareholders, and secretary.

-

Company’s registered office address.

-

Shareholding structure.

-

Paid-up and authorized capital.

📌 Deadline: Within 21 days of the AGM.

2. Return of Share Allotment

When new shares are issued, the company must complete an RJSC Return Filing of share allotment. This filing records:

-

Number of shares allotted.

-

Updated shareholder list.

-

Paid-up capital after allotment.

-

Revised ownership ratio.

📌 Deadline: Within 60 days of allotment.

3. Return of Change of Directors/Officers

Changes in the company’s directors or managing agents must be notified through RJSC Return Filing. Information required includes:

-

Resignation or appointment details.

-

Updated particulars of directors.

-

Board resolution confirming the change.

📌 Deadline: Within 30 days of change.

4. Amendments to Memorandum and Articles of Association

If the company alters its Memorandum of Association (MOA) or Articles of Association (AOA), an RJSC Return Filing is mandatory. Required documents include:

-

Certified copy of the special resolution.

-

Updated MOA & AOA.

-

RJSC-approved amendment papers.

📌 Deadline: Within 15 days of the special resolution.

5. Winding Up and Dissolution Returns

Companies closing their operations must file RJSC Returns for dissolution, which include:

-

Statement of affairs.

-

Final audited accounts.

-

Liquidator’s report.

Required Documents for RJSC Return Filing

The documents required vary by filing type, but generally include:

-

Annual Return: Form XV, audited financial statements, directors’ report.

-

Share Allotment: Form IX, shareholder list, board resolution.

-

Director Changes: Form XII, resignation/appointment documents, board resolution.

-

Amendments: Updated MOA/AOA, certified resolution copy.

-

Dissolution: Final accounts, liquidator’s report.

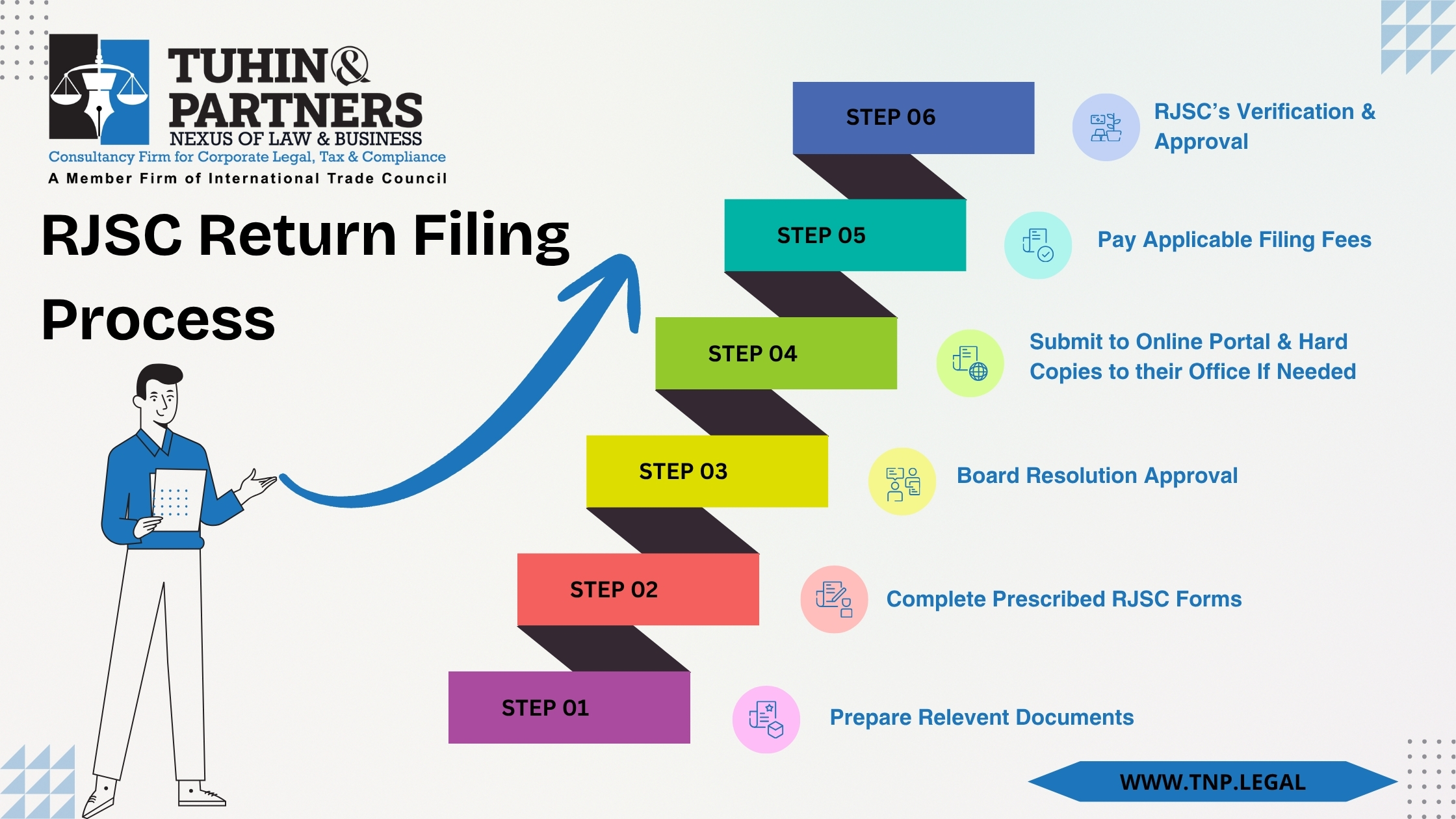

RJSC Return Filing Process

The process of RJSC Return Filing follows a clear sequence:

Penalties for Non-Compliance in RJSC Return Filing

Failing to meet deadlines for RJSC Return Filing results in:

-

Daily fines for directors and company officers.

-

Additional late filing charges.

-

Legal consequences, including restrictions on operations.

Importance of Timely RJSC Return Filing

-

Ensures compliance with the Companies Act 1994.

-

Protects directors from liability and penalties.

-

Builds investor and shareholder confidence.

-

Supports banking and investment transactions.

-

Strengthens corporate governance in Bangladesh.

Professional Assistance for RJSC Return Filing

We provide comprehensive RJSC Return Filing services to ensure your company remains fully compliant. Our services include:

-

Preparing and filing annual and statutory returns.

-

Drafting board resolutions and legal documents.

-

Liaison with RJSC authorities.

-

Advisory on restructuring, capital changes, and amendments.

-

Ongoing compliance monitoring.

With professional support, businesses can avoid costly penalties and maintain smooth corporate operations.

Conclusion

RJSC Return Filing in Bangladesh is a legal requirement that demands accuracy, timely submission, and compliance with prescribed formats. Whether it’s an annual return, a change in directors, a share allotment, or amendments to corporate documents, companies must ensure proper filing to protect their legal standing and credibility.

By following the correct RJSC Return Filing process, businesses safeguard their operations, maintain regulatory compliance, and build long-term trust with stakeholders.

1. Private Company (RJSC Return Filing)

Private companies are to submit the following returns for filing.

A. Annual Returns

- Schedule X - Annual summary of share capital and list of shareholders, Directors: to be filed within 21 days of AGM [Section 36].

- Balance Sheet: to be filed within 30 days of AGM.

- Profit & Loss Account: to be filed within 30 days of AGM.

- Form 23B – Notice by Auditor: to be filed within 30 days of receiving appointment information from the company [Section 210 (2)].

B. Returns for Change

- Filled in Form III - Notice of consolidation, division, subdivision, or conversion into stock of shares: to be filed within 15 days of consolidation and division, etc. [Sections 53 & 54].

- Filled in Form IV - Notice of increase share capital: to be filed within 15 days of increase of share capital/member [Section 56].

- Filled in Form VI - Notice of situation of Registered Office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form VIII – Special Resolution/ Extraordinary Resolution, including name change, conversion into a public company, alteration of the memorandum of association, alteration of articles of association, etc, to be filed within 15 days of the meeting [Section 88 (1)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XV - Return of allotment: to be filed within 60 days of allotment [Section 151].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of the date of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of the date satisfaction [Section 12 & 391].

- Filled in Form 117 - Instrument of Transfer of Shares.

- Digital copy of original Memorandum & Articles of Association

2. Public Company (RJSC Return Filing)

Public companies are to submit the following returns for filing.

A. Annual Returns

- Schedule X - Annual summary of share capital and list of shareholders, Directors: to be filed within 21 days of AGM [Section 36].

- Balance Sheet: to be filed within 30 days of AGM.

- Profit & Loss Account: to be filed within 30 days of AGM

- Form 23B – Notice by Auditor: to be filed within 30 days of receiving appointment information from the company [Section 210 (2)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

B. Returns for Change

- Filled in Form III - Notice of consolidation, division, subdivision, or conversion into the stock of shares: to be filed within 15 days of consolidation and division, etc. [Sections 53 & 54].

- Filled in Form IV - Notice of increase share capital: to be filed within 15 days of increase of share capital/member [Section 56].

- Filled in Form VI - Notice of situation of Registered Office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form VII – Statutory report: to be filed after sending a copy of the statutory report to the members not less than 21 days before the meeting [Section 83].

- Filled in Form VIII – Special Resolution/ Extraordinary Resolution, including name change, conversion into a private company, alteration of the memorandum of association, alteration of articles of association, etc.: to be filed within 15 days of the meeting [Section 88 (1)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XV - Return of allotment: to be filed within 60 days of allotment [Section 151].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Filled in Form 117 - Instrument of Transfer of Share.

- Prospectus for the issue of shares: to be filed at least 3 days before the 1st allotment of shares or debentures [Section 141].

- Prospectus following conversion of Private Company into Public Company [Section 231].

- Digital copy of original Memorandum & Articles of Association.

3. Foreign Company (RJSC Return Filing)

A. Annual Returns

- Balance sheet

- Profit & loss account or income or expenditure account (if not trading for profit).

B. Returns for Change

- Filled in form XL: Notice of alteration in charter, etc. [Section 277].

- Filled in form XLI: Notice of alteration in the address of the registered or principal office of the company [Section 277].

- Filled in form XLII: Notice of situation of the principal place of business in Bangladesh or of any change therein [Section 379 (I)].

- Filled in form XXXVIII: List of Directors and Managers [Section 379].

- Filled in form XXXIX: Return of persons authorized to accept service [Section 379].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Digital copy of original Memorandum & Articles of Association

4. Trade Organization (RJSC Return Filing)

A. Annual Returns

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Balance Sheet: to be filed within 30 days of AGM

- Income and Expenditure Account

B. Returns for Change

- Filled in Form VI - Notice of situation of registered office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Digital copy of original Memorandum & Articles of Association

5. Society (RJSC Return Filing)

A. Annual Returns

- Annual list of Managing Body: to be filed within 14 days of AGM or in January if the rules do not provide for an AGM.

B. Returns for Change

- Filing of Change of Address.

- Filing of Alteration of Name.

- Digital copy of the original Memorandum of Association

6. Partnership Firm (RJSC Return Filing)

Returns for Change

- Filled in Form II – Notice of alteration of name or principal place of business of the firm.

- Filled in Form V – Intimation for the recording of changes in the constitution of a firm [Section 63 & Rule 4 (6)].

- Filled in Form VI – Notice of intimation for dissolution of the partnership firm [Section 63 (1) & Rule (6)].

1. Private Company (RJSC Return Filing)

Private companies are to submit the following returns for filing.

A. Annual Returns

- Schedule X - Annual summary of share capital and list of shareholders, Directors: to be filed within 21 days of AGM [Section 36].

- Balance Sheet: to be filed within 30 days of AGM.

- Profit & Loss Account: to be filed within 30 days of AGM.

- Form 23B – Notice by Auditor: to be filed within 30 days of receiving appointment information from the company [Section 210 (2)].

B. Returns for Change

- Filled in Form III - Notice of consolidation, division, subdivision, or conversion into stock of shares: to be filed within 15 days of consolidation and division, etc. [Sections 53 & 54].

- Filled in Form IV - Notice of increase share capital: to be filed within 15 days of increase of share capital/member [Section 56].

- Filled in Form VI - Notice of situation of Registered Office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form VIII – Special Resolution/ Extraordinary Resolution, including name change, conversion into a public company, alteration of the memorandum of association, alteration of articles of association, etc, to be filed within 15 days of the meeting [Section 88 (1)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XV - Return of allotment: to be filed within 60 days of allotment [Section 151].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of the date of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of the date satisfaction [Section 12 & 391].

- Filled in Form 117 - Instrument of Transfer of Shares.

- Digital copy of original Memorandum & Articles of Association

2. Public Company (RJSC Return Filing)

Public companies are to submit the following returns for filing.

A. Annual Returns

- Schedule X - Annual summary of share capital and list of shareholders, Directors: to be filed within 21 days of AGM [Section 36].

- Balance Sheet: to be filed within 30 days of AGM.

- Profit & Loss Account: to be filed within 30 days of AGM

- Form 23B – Notice by Auditor: to be filed within 30 days of receiving appointment information from the company [Section 210 (2)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

B. Returns for Change

- Filled in Form III - Notice of consolidation, division, subdivision, or conversion into the stock of shares: to be filed within 15 days of consolidation and division, etc. [Sections 53 & 54].

- Filled in Form IV - Notice of increase share capital: to be filed within 15 days of increase of share capital/member [Section 56].

- Filled in Form VI - Notice of situation of Registered Office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form VII – Statutory report: to be filed after sending a copy of the statutory report to the members not less than 21 days before the meeting [Section 83].

- Filled in Form VIII – Special Resolution/ Extraordinary Resolution, including name change, conversion into a private company, alteration of the memorandum of association, alteration of articles of association, etc.: to be filed within 15 days of the meeting [Section 88 (1)].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XV - Return of allotment: to be filed within 60 days of allotment [Section 151].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Filled in Form 117 - Instrument of Transfer of Share.

- Prospectus for the issue of shares: to be filed at least 3 days before the 1st allotment of shares or debentures [Section 141].

- Prospectus following conversion of Private Company into Public Company [Section 231].

- Digital copy of original Memorandum & Articles of Association.

3. Foreign Company (RJSC Return Filing)

A. Annual Returns

- Balance sheet

- Profit & loss account or income or expenditure account (if not trading for profit).

B. Returns for Change

- Filled in form XL: Notice of alteration in charter, etc. [Section 277].

- Filled in form XLI: Notice of alteration in the address of the registered or principal office of the company [Section 277].

- Filled in form XLII: Notice of situation of the principal place of business in Bangladesh or of any change therein [Section 379 (I)].

- Filled in form XXXVIII: List of Directors and Managers [Section 379].

- Filled in form XXXIX: Return of persons authorized to accept service [Section 379].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Digital copy of original Memorandum & Articles of Association

4. Trade Organization (RJSC Return Filing)

A. Annual Returns

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Balance Sheet: to be filed within 30 days of AGM

- Income and Expenditure Account

B. Returns for Change

- Filled in Form VI - Notice of situation of registered office and any change therein: to be filed within 28 days of establishment or change [Section 77].

- Filled in Form IX - Consent of Director to act: to be filed within 30 days of appointment [Section 92].

- Filled in Form XII - Particulars of the Directors, Manager, and Managing Agents and of any change therein: to be filed within 14 days from the date of appointment or change [Section 115].

- Filled in Form XVIII - Particulars of mortgages or charges: to be filed within 21 days of the creation of the mortgage or charge [Section 159 & 391].

- Filled in Form XIX - Particulars of Modification of Mortgage or Charge: to be filed within 21 days of modification [Section 167(3) & 319].

- Filled in Form XXVIII - Memorandum of satisfaction of mortgage charge: to be filed within 21 days of satisfaction [Section 12 & 391].

- Digital copy of original Memorandum & Articles of Association

5. Society (RJSC Return Filing)

A. Annual Returns

- Annual list of Managing Body: to be filed within 14 days of AGM or in January if the rules do not provide for an AGM.

B. Returns for Change

- Filing of Change of Address.

- Filing of Alteration of Name.

- Digital copy of the original Memorandum of Association

6. Partnership Firm (RJSC Return Filing)

Returns for Change

- Filled in Form II – Notice of alteration of name or principal place of business of the firm.

- Filled in Form V – Intimation for the recording of changes in the constitution of a firm [Section 63 & Rule 4 (6)].

- Filled in Form VI – Notice of intimation for dissolution of the partnership firm [Section 63 (1) & Rule (6)].