Doing Business in Bangladesh

Introduction

Market Overview

Entering the Market

Immigration and Labor Landscape

Setting Up a Business

Taxation System

Banking and Financial System

Trade and Customs Regulations

Real Estate and Infrastructure

Intellectual Property Rights

Key Compliance and Reporting Requirements

Dispute Resolution and Legal System

Industry-Specific Opportunities and Challenges

Government Incentives and Special Economic Zones

Emerging Trends and Future Outlook

Conclusion

1. Introduction

Bangladesh has emerged as one of the fastest-growing economies in South Asia, demonstrating remarkable resilience and adaptability. As the country strides towards its “Vision 2041” goal of becoming a developed economy, 2025 marks a crucial year in its economic transformation. With a rapidly expanding digital economy, a strong push towards renewable energy, extensive urban development projects, and regulatory reforms, Bangladesh presents a dynamic landscape for businesses and investors. The government’s “Smart Bangladesh 2041” initiative is driving digitalization across industries, enhancing the ease of doing business and fostering innovation. Additionally, strategic investments in infrastructure, urban planning, and green energy are creating new opportunities for local and international enterprises. However, challenges such as bureaucratic complexities, infrastructure bottlenecks, and regulatory uncertainties remain. This guide provides a comprehensive overview of Bangladesh’s business environment in 2025, highlighting key sectors, investment prospects, and emerging trends that will shape the future of commerce in the country.

1.1. Overview of Bangladesh’s Business Environment

Bangladesh has emerged as one of South Asia’s fastest-growing economies. It offers a dynamic business environment fueled by a young workforce, an expanding industrial base, and strong consumer demand. The country’s strategic location, coupled with a competitive labor force, makes it an attractive destination for investors seeking growth opportunities in Asia.

Economic Growth and Stability

Despite global uncertainties, Bangladesh has maintained a steady GDP growth rate, historically averaging above 6% over the past decade. The government has focused on infrastructure development, digitization, and policy reforms to sustain economic progress. However, in recent years, challenges such as inflation, foreign exchange volatility, and energy shortages have posed obstacles to business operations.

Key Sectors and Investment Potential

Several high-potential sectors, including textiles and garments, agriculture, ICT, pharmaceuticals, energy, and construction, drive the country’s economy. The government has introduced incentives for foreign direct investment (FDI) in priority industries such as manufacturing, renewable energy, and export-oriented businesses. Special Economic Zones (SEZs) and industrial parks offer additional benefits to investors.

Business Climate and Reforms

Bangladesh continues to improve its ease of doing business through regulatory reforms and digital initiatives. Efforts to streamline company registration, reduce bureaucratic hurdles, and enhance trade facilitation have improved investor confidence. However, issues related to contract enforcement, access to finance, and bureaucratic inefficiencies remain areas of concern.

Trade and Global Integration

Bangladesh enjoys duty-free and preferential trade access to key markets, including the European Union, the United States, and central Asian economies. It is a key member of regional trade blocs such as SAARC and BIMSTEC, fostering trade connectivity. The transition from a Least Developed Country (LDC) to a developing nation by 2026 presents both opportunities and challenges, as preferential trade benefits may change.

Challenges and Risks

While Bangladesh offers significant business opportunities, investors must navigate challenges such as infrastructure bottlenecks, corruption, and regulatory unpredictability. Political stability, supply chain disruptions, and financial sector vulnerabilities also influence the overall investment

1.2. Key economic indicators (GDP, inflation, population, major industries)

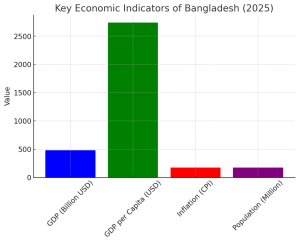

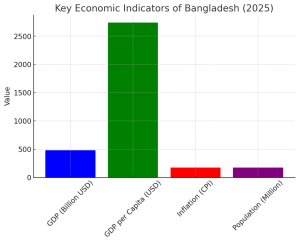

Bangladesh’s economy is projected to reach a GDP of $481.86 billion in 2025, reflecting steady growth. The GDP per capita is expected to be $2,740, driven by industrial expansion and rising consumer demand. The country’s inflation rate, measured by the Consumer Price Index (CPI), is forecasted at 174.90, indicating persistent price pressures. Bangladesh’s population is projected to be 173.736 million, providing a large labor force and consumer market. Key industries, including textiles, agriculture, ICT, and pharmaceuticals, continue to drive economic momentum. Despite challenges like inflation and regulatory hurdles, Bangladesh remains a promising investment destination in South Asia.

Bangladesh’s economy is projected to reach a GDP of $481.86 billion in 2025, reflecting steady growth. The GDP per capita is expected to be $2,740, driven by industrial expansion and rising consumer demand. The country’s inflation rate, measured by the Consumer Price Index (CPI), is forecasted at 174.90, indicating persistent price pressures. Bangladesh’s population is projected to be 173.736 million, providing a large labor force and consumer market. Key industries, including textiles, agriculture, ICT, and pharmaceuticals, continue to drive economic momentum. Despite challenges like inflation and regulatory hurdles, Bangladesh remains a promising investment destination in South Asia. 1.3. Investment climate and ease of doing business ranking

Bangladesh’s investment climate and ease of doing business ranking depends on a number of factors, including corruption, bureaucratic red tape, and government support.

Investment climate

Corruption: A significant factor that has hurt Bangladesh’s investment climate

Bureaucratic red tape: A significant factor that has hurt Bangladesh’s investment climate.

Foreign direct investment (FDI): The flow of FDI has been stagnant, contributing only 0.5% to the GDP.

Promotional efforts: There is a lack of promotional efforts to encourage structural investments in domestic industries.

Ease of doing business ranking

The World Bank’s Ease of Doing Business Index has been replaced by the Business Ready (B-READY) initiative.

The B-READY 2024 report assesses the business environment across 50 economies.

Bangladesh has been working to improve its ranking, with the goal of achieving a double-digit ranking.

The government supports Pro-business policies, Improved ease-of-business rankings, and Ongoing legal reforms.

Other considerations include Bangladesh’s strategic location in Asia and The country’s rapid development of core infrastructures.

2. Market Overview

Bangladesh’s economy is projected to grow between 3% and 5% in 2025, facing hurdles like political instability, inflation, and banking sector challenges. Inflation is expected to decline within the 7-8% range, but high non-performing loans (NPLs) in the banking sector remain a concern. The country’s graduation from the LDC category in 2026 will reshape trade dynamics. The government is focusing on renewable energy, targeting 40% by 2041, offering incentives for solar and wind projects. While challenges persist, Bangladesh’s stock market outlook remains positive for late 2025, signaling potential investment opportunities amid economic uncertainties.

2.1. Economic landscape and key sectors (manufacturing, agriculture, IT, construction, energy)

Manufacturing, agriculture, construction, and energy shape Bangladesh’s economic landscape. The manufacturing sector, led by textiles and garments, remains the backbone of exports. Agriculture supports employment and food security, with modernization efforts improving productivity. The IT sector is rapidly growing, driven by government incentives and a thriving startup ecosystem. Construction is expanding due to infrastructure megaprojects, including highways, bridges, and urban developments. The energy sector is shifting towards renewable sources, with a 40% clean energy target by 2041. While challenges exist, these sectors offer substantial investment opportunities for sustainable economic growth in Bangladesh.

2.2. Trade agreements and economic partnerships (e.g., CPEC, SAARC, WTO)

Bangladesh’s strategic engagement in trade agreements and economic partnerships is pivotal as it approaches its 2026 graduation from Least Developed Country (LDC) status. To mitigate potential challenges from losing preferential market access, Bangladesh has proactively developed a Regional Trade Agreement (RTA) Policy in 2022. Under this framework, the country has initiated negotiations for significant agreements, including an Economic Partnership Agreement (EPA) with Japan and a Comprehensive Economic Partnership Agreement (CEPA) with India. Additionally, Bangladesh has conducted 26 feasibility studies to explore Preferential Trade Agreements (PTAs), Free Trade Agreements (FTAs), CEPAs, and EPAs with major trading partners.

Regionally, Bangladesh is a member of the South Asian Association for Regional Cooperation (SAARC) and participates in the South Asian Free Trade Area (SAFTA), which succeeded the 1993 SAARC Preferential Trading Arrangement and came into force in 2006. The country also engages in the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), aiming to promote free trade in the region.

Globally, Bangladesh is an active member of the World Trade Organization (WTO), aligning its trade policies with international standards. The government’s strategic approach to trade agreements aims to bolster economic resilience and sustain growth in the post-LDC graduation era.

2.3. Legal and regulatory framework

In 2025, Bangladesh introduced significant legal reforms in cybersecurity and banking. The Cyber Security Ordinance 2024 grants the Director General of the National Cyber Security Agency extensive powers, including content restriction and user data access, raising concerns about potential overreach and infringement on freedom of expression.

Concurrently, the Bank Resolution Ordinance 2025 empowers the Bangladesh Bank to intervene in financially unstable banks, allowing actions such as appointing administrators, transferring shares, and establishing bridge banks to manage failing institutions.

These developments underscore Bangladesh’s efforts to enhance regulatory oversight in critical sectors and highlight the need to balance enforcement with the protection of fundamental rights.

2.4. Government structure and business policies

In 2025, Bangladesh is undergoing significant governmental reforms to enhance democratic governance and stimulate economic growth. The interim administration, led by Nobel laureate Muhammad Yunus, is preparing for upcoming elections and is committed to establishing a more inclusive political framework. The newly formed National Citizens’ Party (NCP), emerging from student-led movements, advocates for a “second republic,” aiming to draft a new democratic constitution that ensures broader representation.

On the economic front, the government has approved the establishment of economic zones to attract foreign investment and boost trade. Additionally, policies such as cash incentives, duty drawbacks, and subsidized financing have been introduced to support export-oriented industries. These initiatives reflect Bangladesh’s dedication to creating a conducive environment for business and investment.

3. Entering the Market

Bangladesh presents promising investment opportunities across various sectors in 2025. The Dhaka Stock Exchange (DSE) has started the year on a positive note, attracting both local and foreign investors. The Buy Now Pay Later (BNPL) market is projected to reach $1.92 billion, reflecting a growing consumer finance sector.

Additionally, the technology and renewable energy sectors are gaining traction, aligning with global trends toward sustainability. Foreign investors must obtain a business visa for short-term visits and a residence permit for extended stays. Specific industries may require approval from the Bangladesh Investment Development Authority (BIDA). It is also important to note that Bangladesh maintains strict foreign exchange controls, necessitating compliance with regulations set by the Bangladesh Bank. The legal system is rooted in English common law, with the Constitution serving as the primary legal framework. To navigate this emerging market effectively, investors are advised to utilize real-time data, diversify portfolios, adopt long-term investment strategies, and stay informed about market developments.

3.1. Overview of foreign direct investment (FDI) policies

In 2025, Bangladesh implemented strategic policies to enhance foreign direct investment (FDI), focusing on regulatory improvements, infrastructure development, and leveraging competitive advantages. A key initiative is the introduction of the FDI Heatmap, a data-driven framework targeting 19 high-potential sectors such as renewable energy, pharmaceuticals, and agro-processing. This tool serves as a strategic blueprint for guiding investment promotion efforts.

The regulatory framework has been refined to facilitate sustainable development. Under the principle of non-discrimination, 100% foreign ownership in most sectors is allowed. This approach ensures equal treatment for foreign investors, fostering a more inclusive investment environment.

Infrastructure development is a priority, and the government is enhancing facilities to support sustainable growth through FDI. These improvements aim to create a conducive environment for investors, address logistical challenges, and promote efficient operations.

To streamline investment processes, the Bangladesh Investment Development Authority (BIDA) offers a One Stop Service (OSS) portal, providing time-bound and transparent services to investors. This platform simplifies procedures, reduces bureaucratic hurdles, and expedites project implementation.

Collectively, these policies underscore Bangladesh’s commitment to attracting foreign investment by creating a favorable and competitive business landscape.

3.2. Investment promotion authorities (BIDA, BEPZA, BEZA, Hi-Tech Park Authority, BSCIC)

In 2025, Bangladesh plans to merge its existing investment promotion agencies into a single Investment Promotion Agency (IPA) to streamline investment processes and attract more Foreign Direct Investment (FDI). Currently, key agencies include:

Bangladesh Investment Development Authority (BIDA): The primary investment promotion agency responsible for facilitating local and foreign investments.

Bangladesh Export Processing Zones Authority (BEPZA): Oversees Export Processing Zones (EPZs) to boost export-oriented industries.

Bangladesh Economic Zones Authority (BEZA): Develops Economic Zones (EZs) to encourage industrial growth.

Hi-Tech Park Authority: Promotes investments in the technology sector.

Bangladesh Small and Cottage Industries Corporation (BSCIC): Supports small and cottage industries.

The new centralized IPA aims to enhance efficiency, reduce bureaucratic delays, and attract higher FDI.

3.3. Key business hubs (Dhaka, Chittagong, Barishal, Khulna)

Bangladesh’s key business hubs—Dhaka, Chittagong, Barishal, and Khulna—play vital roles in the country’s economic growth.

Dhaka, the capital and financial center, is home to corporate headquarters, industrial zones, and a thriving startup ecosystem.

Chittagong, home to the country’s largest seaport, is a gateway for international trade and a central industrial and logistics hub.

Barishal, strategically located along river routes, supports the agribusiness and fisheries industries.

Khulna, known for shipbuilding, jute processing, and seafood exports, is an emerging industrial hub.

These cities collectively drive Bangladesh’s economy, offering diverse investment opportunities across multiple sectors.

3.4. Common challenges for foreign investors

Foreign investors in Bangladesh face several challenges despite the country’s investment potential. Regulatory hurdles and bureaucratic inefficiencies can slow business registration and approvals. Foreign exchange controls make profit repatriation complex, affecting investor confidence. Infrastructure gaps, including inconsistent power supply and inadequate logistics, increase operational costs. Policy uncertainty and changes in regulations create unpredictability for long-term investments. Corruption and governance issues add to business risks. Land acquisition difficulties and disputes further complicate investments. Additionally, political instability and labor unrest pose challenges. Addressing these issues through reforms and improved governance is essential to restoring investor confidence and attracting sustainable FDI.

4.1. Work Visas and Entry Permits

Foreign nationals intending to work in Bangladesh must obtain an Employment (E) Visa, issued for an initial period of three months and extendable up to three years. Employers must secure approval from the Bangladesh Investment Development Authority (BIDA) before hiring expatriates. Upon arrival, employees must register with the local authorities and apply for a work permit within 15 days. Additionally, professionals in specific sectors may require approvals from other regulatory bodies. Stringent documentation, including employment contracts and company endorsements, is mandatory. Compliance with visa and work permit regulations is crucial to avoid penalties and legal complications.

4.2. Employment Regulations and Labor Laws

The Bangladesh Labour Act of 2006 governs employment practices, ensuring worker rights, fair wages, and safe working conditions. It sets provisions for working hours, overtime pay, contract terms, termination policies, and dispute resolution mechanisms. Employees are entitled to annual, casual, and sick leave, along with maternity benefits. The law also mandates workplace safety standards, preventing hazardous conditions. Trade unions are legally recognized, allowing collective bargaining and industrial actions. Employers must comply with local labor laws to avoid legal disputes and ensure a fair work environment. Amendments and updates to labor laws continue to align with economic and industrial developments.

4.3. Hiring Local vs. Expatriate Employees

Bangladesh encourages local employment to support workforce development, requiring employers to justify hiring expatriates for specialized roles. Companies must demonstrate that no qualified local professionals are available before recruiting foreign employees. Expatriates typically fill positions in sectors like IT, engineering, and finance, where expertise is scarce. Hiring locals reduces costs and ensures smoother compliance with labor laws. However, expatriates bring international expertise, improving business operations and knowledge transfer. Employers must balance workforce localization with business needs while adhering to BIDA’s expatriate employment policies, ensuring that foreign hires are justified and contribute to the country’s economic growth.

4.4. Minimum Wage and Salary Trends

Bangladesh’s minimum wage structure varies by industry and is periodically revised by the government. As of recent updates, the minimum wage for the garment sector, the country’s largest employer, has been set at BDT 12,500 per month. Salaries for skilled workers and professionals depend on industry demand, experience, and economic conditions. Foreign employees generally receive higher compensation, including housing, healthcare, and travel allowances. Rapid industrialization and foreign investments are driving salary growth, but disparities exist across sectors. Employers should stay updated on wage regulations to ensure compliance and maintain a competitive compensation structure in the evolving labor market.

5.1. Business Structures

Bangladesh offers various business structures, each catering to different needs. A Private Limited Company (LTD) is the most common, requiring at least two shareholders and offering limited liability. A Public Limited Company (PLC) can raise capital from the public and must have at least seven shareholders. A Branch Office allows foreign companies to operate without full incorporation but requires approval from the Bangladesh Investment Development Authority (BIDA). The One Person Company (OPC) is a new option for solo entrepreneurs. A sole proprietorship is the simplest structure and is ideal for small businesses, though it lacks limited liability protection.

5.2. Registration Requirements and Procedures

Registering a business in Bangladesh involves multiple steps. First, companies must obtain name clearance from the Registrar of Joint Stock Companies and Firms (RJSC). After submitting incorporation documents, businesses must acquire a Tax Identification Number (TIN) from the National Board of Revenue (NBR). Additionally, Value Added Tax (VAT) registration is required for applicable businesses. A trade license from the local municipality is mandatory for operations. Depending on the sector, companies may also need sector-specific licenses. The entire process ensures regulatory compliance, enabling businesses to operate legally and maintain credibility in Bangladesh’s commercial environment.

5.3. Capital Requirements and Ownership Rules

Capital requirements and ownership regulations vary based on business structure and industry. For a Private Limited Company, there is no minimum capital requirement, but an initial investment is needed to open a bank account. Public Limited Companies must meet capital thresholds to be listed on the stock exchange. Foreign-owned businesses can generally hold up to 100% ownership, except in restricted sectors like banking and telecommunications, where local ownership is required. Branch Offices cannot generate local revenue but must bring in foreign capital. One-person companies require a minimum paid-up capital of BDT 2.5 million, ensuring financial stability.

5.4. Licensing and Permits

Different industries in Bangladesh require specific licenses and permits. Manufacturing companies need environmental clearances and fire safety approvals. The Bangladesh Bank must license financial institutions. Businesses in the food sector require certification from the Bangladesh Food Safety Authority (BFSA). Export-import companies must obtain an Export Registration Certificate (ERC) or an Import Registration Certificate (IRC). Businesses in telecom, pharmaceuticals, and energy need approvals from respective regulatory bodies. Understanding these sector-specific licensing requirements is crucial to ensuring compliance and avoiding operational disruptions.

5.5. Special Economic Zones and Incentives

Bangladesh offers Special Economic Zones (SEZs) to attract local and foreign investments. Managed by the Bangladesh Economic Zones Authority (BEZA), SEZs provide tax exemptions, customs duty waivers, and streamlined regulatory processes. Businesses in SEZs enjoy up to 10 years of corporate tax holidays, reduced VAT rates, and import duty exemptions on raw materials and machinery. Additionally, the Bangladesh Export Processing Zones Authority (BEPZA) oversees export processing zones (EPZs) that offer similar benefits. SEZs also provide ready infrastructure, simplified business approvals, and preferential access to international markets, making them ideal for industries such as textiles, IT, and manufacturing.

6.1 Overview of Bangladesh’s Tax Structure

Bangladesh operates a dual taxation system comprising direct and indirect taxes. The Income Tax Act, 2023, and Income Tax Rules, 1984 govern direct taxation, which includes corporate and individual income taxes. Indirect taxes, primarily Value-Added Tax (VAT) and customs duties, are levied on the supply of goods and services. The National Board of Revenue (NBR) is the key regulatory body overseeing tax administration. Bangladesh has progressive personal income tax rates and varying corporate tax rates depending on industry and company type. Additionally, tax incentives and exemptions exist for sectors such as export-oriented industries, IT, and renewable energy.

6.2 Corporate Income Tax Rates and Compliance

Corporate tax rates in Bangladesh differ based on business type and listing status. Listed companies generally face a 22.5% corporate tax, whereas unlisted ones pay 30%. Higher rates apply to specific sectors: banks, insurance companies, and financial institutions pay 37.5% (listed) or 40% (unlisted), while telecom operators pay up to 45%. Non-resident companies are taxed at 30% on Bangladesh-sourced income. A minimum tax of 0.3% of gross receipts applies to companies exceeding BDT 5 million in revenue. Compliance requires annual tax return filings by January 15, with quarterly advance tax payments based on prior-year liabilities.

6.3 Withholding Tax and Capital Gains Tax

Bangladesh imposes withholding taxes on various payments, including dividends, interest, royalties, and technical service fees. Rates range from 10% to 20% for residents and 20% to 30% for non-residents, with possible reductions under Double Taxation Agreements (DTAs). Capital gains tax depends on the nature of the asset and holding period. Gains from the sale of listed securities are taxed at 10% for individuals and 15% for companies, while gains from unlisted shares face a 15% tax. Real estate capital gains taxes vary, with different rates applying based on ownership duration and transaction value.

6.4 Value-Added Tax (VAT) and Sales Tax Regulations

The Value-Added Tax and Supplementary Duty Act 2012 mandates a 15% standard VAT rate on most goods and services, with some zero-rated or exempt categories. Specific sectors, such as telecommunications and luxury goods, face supplementary duties in addition to VAT. Import duties range from 3% to 5% based on the type of importer. VAT filings must be submitted monthly by the 15th of the following month. The government is expanding the VAT net, increasing enforcement measures, and digitalizing tax collection to enhance compliance and revenue generation.

6.5 Zakat and Other Levies

Zakat, an Islamic charitable levy, is applicable to Muslims with eligible wealth. The government administers mandatory Zakat collection on certain assets, including bank deposits and shares. Other levies include stamp duties, property taxes, and excise duties on specific goods like tobacco and alcohol. To support economic growth, the government periodically introduces sectoral tax reliefs and incentives for industries such as manufacturing, export-oriented businesses, and IT. Additionally, companies operating in Special Economic Zones (SEZs) enjoy extended corporate tax holidays and reduced VAT obligations to attract foreign investment.

6.6 Double Taxation Agreements and Foreign Tax Implications

To prevent double taxation and promote cross-border trade, Bangladesh has 36 Double Taxation Agreements (DTAs)with countries such as India, the United States, the United Kingdom, Japan, and China. These treaties help avoid double taxation on income, dividends, royalties, and capital gains while providing reduced withholding tax rates for foreign investors. Foreign companies operating in Bangladesh must consider branch remittance tax (20%) if repatriating profits. Additionally, businesses engaged in cross-border transactions must comply with transfer pricing regulations, ensuring fair pricing in intercompany dealings to prevent tax evasion and maintain transparency.

7.1. Banking Sector Overview

In 2025, Bangladesh’s banking sector comprises state-owned commercial banks (SOCBs), specialized banks (SDBs), private commercial banks (PCBs), and foreign commercial banks (FCBs). SOCBs, fully or majority government-owned, account for less than 30% of total banking assets and have higher non-performing loan ratios compared to private banks. S&P classifies Bangladesh’s banking sector risk as ‘9’ out of 10, indicating significant vulnerabilities. The sector faces challenges such as weak profitability, high inflation, and a volatile exchange rate. The central bank’s independence is limited by multiple mandates and underdeveloped markets, impacting effective monetary policy implementation. Despite these challenges, projections indicate a net interest income of approximately US$38.47 billion in 2025, with traditional commercial banking being the dominant player.

7.2. Opening a Corporate Bank Account

Establishing a corporate bank account in Bangladesh requires several key documents: a certificate of incorporation, a valid trade license, a board resolution authorizing the account opening, national ID or passport copies of owners and shareholders, a 12-digit e-TIN certificate, personal information forms and photo IDs for proprietors, directors, and signatories, the Memorandum of Association, updated Forms X and XII, a power of attorney, and recent utility bills as proof of address. While these requirements may vary depending on the legal entity type, maintaining compliance with Bangladeshi laws and regulations is essential for seamless business operations. Consulting a law firm experienced in local regulations can facilitate the process.

7.3. Foreign Exchange Controls and Repatriation of Profits

Bangladesh maintains a structured foreign exchange regime to regulate the inflow and outflow of foreign funds. The Bangladesh Investment Development Authority (BIDA) oversees foreign investments, ensuring compliance with exchange control regulations. Foreign investors are permitted to repatriate profits, dividends, and capital, subject to adherence to specific guidelines established by the Bangladesh Bank. Branch offices of foreign companies, banking, and insurance institutions incorporated in Bangladesh can remit post-tax profits to their head offices through Authorized Dealers (ADs). However, branch offices other than banks and insurance companies require permission from BIDA and Bangladesh Bank for profit remittance. Additionally, foreign citizens legally employed in Bangladesh can remit up to 75% of their monthly salary through an AD after deducting all admissible expenses, savings, and retirement benefits. Adherence to these regulations ensures compliance and facilitates smooth financial operations for foreign investors.

7.4. Credit and Financing Options for Businesses

In Bangladesh, businesses have access to various financing options, including equity financing, debt financing, government grants, and digital financial services. Equity financing avenues encompass direct foreign investments through venture capital and private equity funds, capital injections by promoters into private companies, and rights issuances by listed companies to raise equity. Debt financing is available through loans from domestic or international banks, with the Bangladesh Bank regulating external commercial borrowing to ensure financial stability. The government offers incentives such as cash incentives, duty drawbacks, and subsidized financing, particularly for export-oriented industries. Additionally, the rise of digital financial services, including mobile financial service providers and fintech companies, offers innovative solutions like digital lending, payments, and embedded finance, integrating financial services directly into non-financial platforms. These diverse financing options cater to the varying needs of businesses operating in Bangladesh.

8.1. Import/Export Regulations

Bangladesh enforces strict trade regulations, requiring businesses to obtain valid trade licenses and comply with import/export laws. To submit an Expression of Interest, firms must possess an updated trade license valid until June 30, 2025, alongside essential documents such as a TIN certificate, VAT registration, a firm registration certificate, and bank solvency proof. Importers must adhere to the Import Policy Order (IPO), allowing industrial imports through purchase contracts without Letters of Credit (LCs). Export restrictions limit the amount of local and foreign currency individuals can carry, while certain items, such as firearms and hazardous goods, are prohibited.

8.2. Tariffs and Duties

Bangladesh levies different tariff rates based on the type of goods imported. Customs duty ranges from 2–5% for essential raw materials and capital goods, 10% for intermediate goods, and 25% for final consumer products. The government recently increased the value-added tax (VAT) rate to 15% for various goods and services, including food and industrial products. Supplementary duties have also risen on specific goods. Some products are subject to import bans or restrictions due to safety, national security, or economic concerns. Businesses must account for these taxes and duties while planning import costs to ensure compliance and financial stability.

8.3. Free Trade Agreements and Preferential Market Access

Bangladesh has entered several Free Trade Agreements (FTAs) and Preferential Trade Agreements (PTAs) to enhance trade relations and market access. Existing agreements include the Bangladesh-Bhutan Preferential Trade Agreement (BB-PTA) implemented in 2022, the South Asian Free Trade Area (SAFTA), and the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC). Additionally, Bangladesh is actively negotiating FTAs with Malaysia and Thailand. These agreements aim to reduce tariffs, promote export growth, and attract foreign investments. Special Economic Zones (SEZs) are also being developed to facilitate trade further and boost economic expansion.

8.4. Customs Procedures and Documentation

The customs clearance process in Bangladesh involves multiple steps, beginning with a customs officer’s examination of trade documents. Required paperwork includes a Letter of Credit (L/C), invoice, bill of lading, packing list, certificate of origin, insurance policy, and VAT/BIN certificate. Duties and taxes are assessed based on these documents, and clearance is granted upon payment. The new Customs Act 2023, effective from June 6, 2023, replaces the 1969 law, streamlining revenue collection and improving trade facilitation. The Import Export Hub serves as a comprehensive repository for customs compliance, ensuring efficient import and export processing for businesses.

9.1 Commercial Real Estate Market Trends

The commercial real estate market in Bangladesh is poised for growth in 2025, driven by economic expansion, foreign investments, and rising demand for premium properties. Demand for office spaces and retail properties has surged in major cities like Dhaka and Chittagong, fueled by the expansion of multinational corporations and local enterprises. The market is witnessing increased adoption of innovative technologies, eco-friendly construction, and digital platforms for property management. However, high initial investment costs, market saturation in prime areas, and rising competition among developers present challenges. Government incentives, such as tax breaks and streamlined approval processes, are expected to boost the sector further.

9.2 Land Ownership Laws for Foreigners

Foreigners face restrictions when purchasing land in Bangladesh but can buy residential properties through a locally incorporated company. They can invest in apartments, condominiums, and commercial buildings but are generally prohibited from acquiring agricultural land. Transactions must be completed in foreign currency, and foreign investors must comply with local tax regulations. The Transfer of Property Act of 1882 and the Foreign Private Investment Act of 1980 govern property ownership. Due diligence, legal consultation, and government approvals are essential steps for foreign investors. Forming joint ventures with local entities is another common strategy to navigate ownership restrictions and ensure compliance with national regulations.

9.3 Office Leasing and Industrial Property Acquisition

Office leasing and industrial property acquisition are gaining momentum as Bangladesh positions itself as a regional business and manufacturing hub. The demand for office space remains high in Dhaka, particularly in Gulshan, Banani, and Motijheel. Industrial property acquisition, including factories and warehouses, is expanding due to the growth of export-oriented industries. Investors must secure proper documentation, including lease agreements, environmental clearances, and zoning permits. The government’s incentives for industrial parks and Special Economic Zones (SEZs) attract foreign and local investors, providing tax exemptions and simplified leasing processes. With the rise of e-commerce and logistics services, warehouse demand is also increasing significantly.

9.4 Key Infrastructure Developments (Ports, Roads, Logistics Hubs)

Bangladesh is undergoing major infrastructure transformations to improve trade and connectivity. The Matarbari deep-sea port, expected to be operational by 2026, will enhance maritime trade capacity. The Dhaka Elevated Expressway and the Dhaka Bypass are crucial projects aimed at decongesting urban traffic and improving regional connectivity. The Dhaka MRT Line-5 (Northern and Southern Routes) and the proposed Chittagong Metro Rail will enhance urban mobility. Additionally, the government is developing logistics hubs to support growing trade volumes. These projects are expected to drive economic growth, reduce transportation costs, and attract foreign investments in real estate and industrial sectors.

10.1. Trademarks, Patents, and Copyrights

In Bangladesh, the protection of intellectual property rights is governed by several key legislations. The Trademarks Act 2009 and the Trademark Rules 2015 provide a framework for the registration and enforcement of trademarks, safeguarding brand identities against infringement. The Department of Patents, Designs, and Trademarks (DPDT), established in 2003 under the Ministry of Industries, oversees the registration processes for trademarks, patents, and designs, streamlining procedures and enhancing enforcement mechanisms. Additionally, the Copyright Act 2000 protects original literary, artistic, and musical works, ensuring that creators’ rights are upheld. The Geographical Indication of Goods (Registration and Protection) Act 2013 further safeguards products that have a specific geographical origin and possess qualities or a reputation inherent to that location. These legislative measures collectively aim to foster innovation and protect intellectual property within the country.

10.2. Enforcement and Dispute Resolution

Effective enforcement of intellectual property rights (IPR) in Bangladesh has been a focal point for authorities. In February 2025, the World Customs Organization (WCO) conducted a national workshop in Dhaka to bolster the capacity of the Bangladesh National Board of Revenue (NBR) to enforce IPR at borders. This initiative aimed to equip customs officials with the necessary skills to identify and intercept counterfeit goods, thereby strengthening border enforcement. Despite these efforts, challenges persist, particularly in the enforcement mechanisms and public awareness regarding copyright matters. Civil courts in Bangladesh infrequently grant orders such as seizure, confiscation, or cost impositions, which hampers effective enforcement. To address these issues, there is a growing emphasis on enhancing public awareness and improving the responsiveness of enforcement agencies to create a more robust IP ecosystem.

10.3. Licensing and Franchising Agreements

Licensing and franchising serve as pivotal mechanisms for businesses in Bangladesh to expand their operations and monetize intellectual property assets. Through licensing agreements, intellectual property owners grant permission to third parties to use their IP rights under defined terms, facilitating revenue generation and market expansion. Franchising agreements, on the other hand, allow businesses to replicate successful models by permitting franchisees to operate under the franchisor’s brand and system. These arrangements necessitate comprehensive legal frameworks to protect the interests of both parties and ensure compliance with local laws. As Bangladesh continues to integrate into the global economy, the significance of well-structured licensing and franchising agreements is expected to grow, offering avenues for economic development and the proliferation of established business models.

11. Key Compliance and Reporting Requirements

Bangladesh is actively enhancing its corporate compliance and reporting frameworks to align with international standards and bolster financial transparency. Key areas of focus include:

11.1. Financial Reporting Standards (IFRS Adoption)

The Bangladesh Bank (BB) has outlined a strategic plan to implement the Expected Credit Loss (ECL) methodology, in line with International Financial Reporting Standard (IFRS) 9, by 2027. This transition from a traditional rules-based loan classification system to a forward-looking, risk-based approach aims to improve credit risk assessment by considering past events, current conditions, and future forecasts. The implementation will occur in phases: by June 2026, banks are expected to adopt IFRS 9 on a pilot basis in select branches; by September 2026, this will extend to branches covering at least 25% of total loan portfolios; and by June 2027, to at least 75%. Complete sector-wide alignment with IFRS 9 is anticipated by December 2027. This initiative is expected to enhance financial transparency, strengthen investor confidence, and reshape Bangladesh’s banking landscape.

11.2. Annual Corporate Filings and Deadlines

In Bangladesh, companies are mandated to adhere to annual filing and reporting obligations as stipulated by the Companies Act of 1994. Key requirements include the submission of annual financial statements, tax returns, and other statutory documents to regulatory bodies such as the Registrar of Joint Stock Companies and Firms (RJSC), the National Board of Revenue (NBR), and the Bangladesh Securities and Exchange Commission (BSEC). Timely compliance with these obligations is crucial to maintain corporate governance standards and avoid legal repercussions, including fines and potential cancellation of business licenses. For instance, the deadline for filing monthly Withholding Tax (WHT) returns has been extended from the 15th to the 25th of each month under the new Income-tax Act, 2023. Adherence to these deadlines ensures transparency and accountability within the corporate sector.

11.3. Auditing Requirements

Bangladesh’s auditing standards are aligned with international benchmarks to ensure the reliability of financial reporting. The Institute of Chartered Accountants of Bangladesh (ICAB) has adopted International Standards on Auditing (ISA) to guide the auditing process. Companies are required to conduct annual audits by qualified professionals to verify the accuracy of financial statements. The audit process encompasses planning, notification, opening meetings, fieldwork, report drafting, management responses, closing meetings, and the distribution of the final audit report. This structured approach ensures a comprehensive evaluation of a company’s financial health and compliance with applicable laws and regulations. The Financial Reporting Council (FRC) oversees the enforcement of these standards, aiming to enhance the quality and credibility of financial reporting in the country.

11.4. Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws

Bangladesh has strengthened its regulatory framework to combat money laundering and terrorism financing. The Bangladesh Financial Intelligence Unit (BFIU), under the Money Laundering Prevention Act, 2012 (amended in 2015), issues guidelines and circulars to enforce compliance. Financial institutions are mandated to implement Know Your Customer (KYC) policies, establish Central Compliance Committees (CCC), and develop transaction monitoring and reporting processes to identify and report suspicious activities. Training programs are also conducted to enhance staff awareness regarding AML and CTF obligations. Non-compliance can result in severe penalties, including fines and imprisonment. These measures align with international standards set by organizations such as the Asia/Pacific Group on Money Laundering (APG) and the Financial Action Task Force (FATF), reinforcing Bangladesh’s commitment to global financial integrity.

By focusing on these key compliance and reporting requirements, Bangladesh aims to foster a more transparent, accountable, and robust financial environment conducive to sustainable economic growth.

12. Dispute Resolution and Legal System

Bangladesh’s judicial framework for commercial disputes encompasses both traditional court litigation and Alternative Dispute Resolution (ADR) mechanisms, such as arbitration and mediation. Understanding these avenues is crucial for businesses aiming to navigate legal challenges effectively and mitigate potential risks.

12.1. Judicial Framework and Commercial Courts

Commercial disputes in Bangladesh are primarily addressed within the civil court system, governed by the Code of Civil Procedure of 1908. While there is not a distinct hierarchy of commercial courts, certain courts handle cases based on the dispute’s monetary value and jurisdiction. This structure can sometimes lead to prolonged proceedings due to caseloads and procedural intricacies.

12.2. Alternative Dispute Resolution (ADR) Mechanisms

To enhance the efficiency of dispute resolution, Bangladesh has integrated ADR methods into its legal system:

Arbitration: The Arbitration Act of 2001, which aligns with the UNCITRAL Model Law, governs arbitration, which serves as a binding method to resolve disputes outside traditional courts. This act facilitates both domestic and international arbitration and provides a framework for the enforceability of arbitral awards.

Mediation: Sections 89A, 89B, and 89C of the Code of Civil Procedure introduce mediation as a voluntary, confidential, and non-binding process. Mediation emphasizes mutual agreement facilitated by an impartial third party, aiming for amicable settlements without the need for formal litigation.

12.3. Enforcement of Foreign Judgments and Arbitral Awards

Bangladesh’s approach to enforcing foreign judgments is selective, primarily recognizing those from jurisdictions with reciprocal arrangements. The process involves filing a certified copy of the foreign judgment in a Bangladeshi district court, followed by standard enforcement procedures. However, the enforcement of foreign judgments is relatively rare, with parties often opting for local litigation or arbitration.

Conversely, the enforcement of foreign arbitral awards is more streamlined, especially since Bangladesh is a signatory to the New York Convention. The Arbitration Act of 2001 facilitates the recognition and enforcement of these awards, reflecting the country’s commitment to international arbitration standards.

12.4. Mitigating Legal Risks in Business

To effectively manage legal risks in Bangladesh, businesses should consider the following strategies:

Incorporate ADR Clauses: Including arbitration or mediation clauses in contracts can provide more control over dispute resolution processes, potentially reducing the time and costs associated with litigation.

Understand Local Laws: Familiarity with Bangladesh’s legal framework, including specific regulations pertinent to your industry, is essential. This knowledge aids in compliance and informs risk management practices.

Engage Local Expertise: Consulting with local legal professionals can offer valuable insights into effectively navigating the judicial system and ADR mechanisms.

Stay Informed on Legal Developments: Regularly monitoring changes in laws and regulations ensures that business practices remain compliant and can adapt to new legal challenges.

By proactively engaging with Bangladesh’s judicial and ADR frameworks, businesses can better navigate the complexities of contract enforcement and dispute resolution, thereby mitigating potential legal risks.

13.1. Manufacturing and Exports

Bangladesh’s manufacturing sector, particularly the ready-made garments (RMG) industry, has been a cornerstone of its economy. To sustain growth, there is a pressing need to enhance productivity through technology adoption and innovation. A World Bank report emphasizes that firms with higher technology levels in Bangladesh’s manufacturing sector perform better, suggesting that strengthening innovation and technology adoption can boost productivity.

Additionally, diversifying exports beyond RMG is crucial to mitigate risks associated with over-reliance on a single sector. Addressing infrastructural bottlenecks and improving the business environment will further bolster export competitiveness.

13.2. Renewable Energy and Power Sector

Bangladesh has made significant strides in electrification, achieving 100% coverage by 2022. The country is now focusing on renewable energy to meet its growing power demands sustainably. Opportunities exist in solar energy projects, as the nation aims to balance energy needs with climate change mitigation efforts. Recently, the Bangladesh government declared 15-year tax holidays in the Renewable energy sector.

However, challenges such as policy implementation, financing, and technological adoption persist. Collaborations with international investors and the adoption of innovative technologies are essential to overcome these hurdles and transition towards a greener energy landscape.

13.3. Technology and Startups

Bangladesh’s startup ecosystem is burgeoning, driven by a young, tech-savvy population and increasing digital connectivity. The government’s support through policies and incentives has fostered innovation and entrepreneurship. However, challenges like access to funding, mentorship, and market access remain. To sustain momentum, it is imperative to strengthen the support infrastructure, encourage public-private partnerships, and focus on capacity building to nurture homegrown startups that can compete globally.

13.4. Infrastructure and Real Estate

The infrastructure and real estate sectors in Bangladesh are experiencing rapid growth, propelled by urbanization and economic development. Investments in mega projects like the Padma Bridge have enhanced connectivity and opened up new economic corridors. Despite these advancements, challenges such as regulatory hurdles, land acquisition issues, and ensuring sustainable urban planning persist. Addressing these challenges through streamlined policies and adopting modern construction technologies is vital for sustained growth.

13.5. Agriculture and Food Processing

Agriculture remains a vital sector in Bangladesh, employing a significant portion of the population. Integrating technology into farming practices can enhance productivity and ensure food security. The food processing industry holds immense potential for value addition and export diversification. However, challenges like supply chain inefficiencies, lack of cold storage facilities, and limited access to credit for farmers hinder progress. Investments in infrastructure, training, and financial inclusion are essential to unlock the full potential of this sector.

13.6. Financial Services and Fintech

Bangladesh’s financial sector is undergoing a digital transformation, with fintech innovations enhancing financial inclusion. Mobile financial services have revolutionized transactions, bringing banking services to the unbanked population. Nonetheless, challenges such as cybersecurity threats, regulatory compliance, and digital literacy need attention. Collaborative efforts between regulators, financial institutions, and tech companies are crucial to building a secure, inclusive, and efficient financial ecosystem that can drive economic growth.

14.1 Investment Incentives and Tax Breaks

Bangladesh offers a range of investment incentives and tax breaks to attract both domestic and foreign investors. These include tax holidays ranging from 5 to 15 years, depending on the industry and location, with more extended exemptions for investments in less developed areas. Additionally, accelerated depreciation of up to 100% on plant and machinery for new industries is available, alongside exemptions on royalties, technical assistance fees, and interest on foreign loans. Export-oriented companies are permitted to sell up to 20% of their products in the domestic market, further enhancing the investment appeal.

14.2 Free Zones and Industrial Parks

To bolster industrial growth, Bangladesh has established Special Economic Zones (SEZs) and industrial parks. The Bangladesh Economic Zones Authority (BEZA), formed in 2010, aims to develop 100 SEZs, with a current focus on five priority zones to attract foreign investment. Notably, the Bangabandhu Hi-Tech City (BHTC) at Kaliakoir stands as the country’s first dedicated SEZ for IT/ITES and high-tech industries. These zones offer benefits such as tax exemptions, reduced import duties, and streamlined regulatory processes, facilitating production for both export and domestic markets. The SEZs are designed to boost employment, strengthen Bangladesh’s manufacturing base, and encourage foreign direct investment. However, the newly joined Executive Chairman of BIDA & BEZA recently declared that they would lower the number from 100 to a few because they want to execute every SEZ properly and one by one phase, and G2G economic zone proposal is always welcome. Recently, Japan took an SEZ, and Bangladesh and Japan are on a path to signing an economic partnership agreement soon.

14.3 Public-Private Partnership Opportunities

Public-private partnerships (PPPs) present significant opportunities in Bangladesh’s infrastructure development. The Public-Private Partnership Authority (PPPA) oversees these collaborations, offering incentives like 100% income tax exemptions for 10 years post-commercial operation and similar exemptions on capital gains, royalties, and technical assistance fees. Foreign technicians also enjoy a 50% tax exemption for three years. Financial support mechanisms, such as Viability Gap Financing, provide subsidies of up to 30% of total project costs for PPP initiatives with high socio-economic value but limited commercial viability. Notable PPP projects include the Hemodialysis Centre at Chittagong Medical College Hospital and the development of water distribution facilities at Purbachal New Town, Dhaka.

15. Emerging Trends and Future Outlook

Bangladesh is poised for significant advancements across various sectors by 2025, reflecting a dynamic shift towards modernization and sustainability.

15.1. Digital Transformation and E-Commerce Growth

The nation’s digital landscape is undergoing rapid transformation, with the e-commerce sector emerging as a pivotal growth driver. The government’s “Digital Bangladesh” initiative has laid the groundwork for a robust digital economy, fostering innovations in mobile financial services and tech startups. The recent draft of the ‘National Digital Transformation Strategy’ aims to expedite this progress, targeting an entire digital economy and innovative governance by 2030 ahead of previous plans.

This strategy envisions Bangladesh ascending into the top 15 nations in the e-government index and becoming a hub for Artificial Intelligence (AI) and Fourth Industrial Revolution (4IR) technologies in South Asia.

However, challenges such as cybersecurity threats and the need for enhanced digital literacy persist, necessitating comprehensive measures to ensure sustainable growth.

15.2. Green Energy Initiatives

Bangladesh is actively embracing green energy solutions in its pursuit of sustainable development. The government has initiated reforms in the power and energy sectors, focusing on transparency and sustainable practices.

The Bangladesh Working Group on Ecology and Development (BWGED) has proposed 16 key reforms to combat corruption and address climate change risks.

Additionally, the Centre for Policy Dialogue (CPD) has outlined a three-step energy transition pathway to enhance efficiency and accountability.

These initiatives are crucial for reducing reliance on fossil fuels, ensuring energy security, and aligning with global sustainability goals.

15.3. Urban Development and Infrastructure Expansion

Urbanization in Bangladesh is accelerating, prompting significant investments in urban development and infrastructure. The government has drafted a new strategy paper aiming for an entire digital economy and innovative governance by 2030, which includes urban planning and housing construction sectors focusing on energy efficiency and sustainability.

This approach addresses the challenges of rapid urbanization and aligns with environmental sustainability goals. The World Bank emphasizes that green growth is essential for Bangladesh to achieve its vision of becoming an upper-middle-income country by 2031, highlighting the importance of sustainable urban development.

15.4. Changing Regulatory Landscape and Government Reforms

Bangladesh is implementing significant regulatory and governmental reforms to navigate contemporary challenges. The interim government has prepared a draft of the National Digital Transformation Strategy, which targets an entire digital economy and innovative governance by 2030.

This strategy aims to position Bangladesh among the top 15 nations in the e-government index and establish the country as a hub for AI and 4IR technologies in South Asia. Additionally, the Centre for Policy Dialogue (CPD) has proposed a three-step energy transition pathway under the interim government to enhance efficiency and accountability in the energy sector.

These reforms are pivotal for fostering a conducive environment for economic growth and ensuring sustainable development.

Collectively, these emerging trends underscore Bangladesh’s commitment to embracing technological advancements, sustainable energy practices, urban modernization, and regulatory reforms, steering the nation toward a resilient and prosperous future.

Conclusion

Bangladesh is undergoing a profound economic transformation, making it an attractive destination for business and investment in 2025. The rapid digitalization of industries, coupled with the exponential growth of e-commerce, is unlocking new business avenues. Simultaneously, the government’s commitment to green energy is fostering sustainability and ensuring long-term economic and environmental benefits. The country’s ambitious urban development plans are reshaping its cities into modern, efficient hubs, further supporting business growth. Moreover, regulatory and policy reforms are gradually addressing bureaucratic hurdles, improving transparency, and streamlining the business process.

While challenges remain—such as the need for more substantial infrastructure, enhanced digital security, and efficient regulatory implementation—Bangladesh’s proactive approach to economic reforms indicates a promising future. Investors who adapt to these emerging trends and navigate the evolving regulatory framework will find abundant opportunities. With a strategic focus on innovation, sustainability, and governance, Bangladesh is on course to solidify its position as a key player in the global economy. Now is the time for businesses to leverage these opportunities and participate in Bangladesh’s growth story.

Introduction

Market Overview

Entering the Market

Immigration and Labor Landscape

Setting Up a Business

Taxation System

Banking and Financial System

Trade and Customs Regulations

Real Estate and Infrastructure

Intellectual Property Rights

Key Compliance and Reporting Requirements

Dispute Resolution and Legal System

Industry-Specific Opportunities and Challenges

Government Incentives and Special Economic Zones

Emerging Trends and Future Outlook

Conclusion

1. Introduction

Bangladesh has emerged as one of the fastest-growing economies in South Asia, demonstrating remarkable resilience and adaptability. As the country strides towards its “Vision 2041” goal of becoming a developed economy, 2025 marks a crucial year in its economic transformation. With a rapidly expanding digital economy, a strong push towards renewable energy, extensive urban development projects, and regulatory reforms, Bangladesh presents a dynamic landscape for businesses and investors. The government’s “Smart Bangladesh 2041” initiative is driving digitalization across industries, enhancing the ease of doing business and fostering innovation. Additionally, strategic investments in infrastructure, urban planning, and green energy are creating new opportunities for local and international enterprises. However, challenges such as bureaucratic complexities, infrastructure bottlenecks, and regulatory uncertainties remain. This guide provides a comprehensive overview of Bangladesh’s business environment in 2025, highlighting key sectors, investment prospects, and emerging trends that will shape the future of commerce in the country.

1.1. Overview of Bangladesh’s Business Environment

Bangladesh has emerged as one of South Asia’s fastest-growing economies. It offers a dynamic business environment fueled by a young workforce, an expanding industrial base, and strong consumer demand. The country’s strategic location, coupled with a competitive labor force, makes it an attractive destination for investors seeking growth opportunities in Asia.

Economic Growth and Stability

Despite global uncertainties, Bangladesh has maintained a steady GDP growth rate, historically averaging above 6% over the past decade. The government has focused on infrastructure development, digitization, and policy reforms to sustain economic progress. However, in recent years, challenges such as inflation, foreign exchange volatility, and energy shortages have posed obstacles to business operations.

Key Sectors and Investment Potential

Several high-potential sectors, including textiles and garments, agriculture, ICT, pharmaceuticals, energy, and construction, drive the country’s economy. The government has introduced incentives for foreign direct investment (FDI) in priority industries such as manufacturing, renewable energy, and export-oriented businesses. Special Economic Zones (SEZs) and industrial parks offer additional benefits to investors.

Business Climate and Reforms

Bangladesh continues to improve its ease of doing business through regulatory reforms and digital initiatives. Efforts to streamline company registration, reduce bureaucratic hurdles, and enhance trade facilitation have improved investor confidence. However, issues related to contract enforcement, access to finance, and bureaucratic inefficiencies remain areas of concern.

Trade and Global Integration

Bangladesh enjoys duty-free and preferential trade access to key markets, including the European Union, the United States, and central Asian economies. It is a key member of regional trade blocs such as SAARC and BIMSTEC, fostering trade connectivity. The transition from a Least Developed Country (LDC) to a developing nation by 2026 presents both opportunities and challenges, as preferential trade benefits may change.

Challenges and Risks

While Bangladesh offers significant business opportunities, investors must navigate challenges such as infrastructure bottlenecks, corruption, and regulatory unpredictability. Political stability, supply chain disruptions, and financial sector vulnerabilities also influence the overall investment

1.2. Key economic indicators (GDP, inflation, population, major industries)

Bangladesh’s economy is projected to reach a GDP of $481.86 billion in 2025, reflecting steady growth. The GDP per capita is expected to be $2,740, driven by industrial expansion and rising consumer demand. The country’s inflation rate, measured by the Consumer Price Index (CPI), is forecasted at 174.90, indicating persistent price pressures. Bangladesh’s population is projected to be 173.736 million, providing a large labor force and consumer market. Key industries, including textiles, agriculture, ICT, and pharmaceuticals, continue to drive economic momentum. Despite challenges like inflation and regulatory hurdles, Bangladesh remains a promising investment destination in South Asia.

Bangladesh’s economy is projected to reach a GDP of $481.86 billion in 2025, reflecting steady growth. The GDP per capita is expected to be $2,740, driven by industrial expansion and rising consumer demand. The country’s inflation rate, measured by the Consumer Price Index (CPI), is forecasted at 174.90, indicating persistent price pressures. Bangladesh’s population is projected to be 173.736 million, providing a large labor force and consumer market. Key industries, including textiles, agriculture, ICT, and pharmaceuticals, continue to drive economic momentum. Despite challenges like inflation and regulatory hurdles, Bangladesh remains a promising investment destination in South Asia. 1.3. Investment climate and ease of doing business ranking

Bangladesh’s investment climate and ease of doing business ranking depends on a number of factors, including corruption, bureaucratic red tape, and government support.

Investment climate

Corruption: A significant factor that has hurt Bangladesh’s investment climate

Bureaucratic red tape: A significant factor that has hurt Bangladesh’s investment climate.

Foreign direct investment (FDI): The flow of FDI has been stagnant, contributing only 0.5% to the GDP.

Promotional efforts: There is a lack of promotional efforts to encourage structural investments in domestic industries.

Ease of doing business ranking

The World Bank’s Ease of Doing Business Index has been replaced by the Business Ready (B-READY) initiative.

The B-READY 2024 report assesses the business environment across 50 economies.

Bangladesh has been working to improve its ranking, with the goal of achieving a double-digit ranking.

The government supports Pro-business policies, Improved ease-of-business rankings, and Ongoing legal reforms.

Other considerations include Bangladesh’s strategic location in Asia and The country’s rapid development of core infrastructures.

2. Market Overview

Bangladesh’s economy is projected to grow between 3% and 5% in 2025, facing hurdles like political instability, inflation, and banking sector challenges. Inflation is expected to decline within the 7-8% range, but high non-performing loans (NPLs) in the banking sector remain a concern. The country’s graduation from the LDC category in 2026 will reshape trade dynamics. The government is focusing on renewable energy, targeting 40% by 2041, offering incentives for solar and wind projects. While challenges persist, Bangladesh’s stock market outlook remains positive for late 2025, signaling potential investment opportunities amid economic uncertainties.

2.1. Economic landscape and key sectors (manufacturing, agriculture, IT, construction, energy)

Manufacturing, agriculture, construction, and energy shape Bangladesh’s economic landscape. The manufacturing sector, led by textiles and garments, remains the backbone of exports. Agriculture supports employment and food security, with modernization efforts improving productivity. The IT sector is rapidly growing, driven by government incentives and a thriving startup ecosystem. Construction is expanding due to infrastructure megaprojects, including highways, bridges, and urban developments. The energy sector is shifting towards renewable sources, with a 40% clean energy target by 2041. While challenges exist, these sectors offer substantial investment opportunities for sustainable economic growth in Bangladesh.

2.2. Trade agreements and economic partnerships (e.g., CPEC, SAARC, WTO)

Bangladesh’s strategic engagement in trade agreements and economic partnerships is pivotal as it approaches its 2026 graduation from Least Developed Country (LDC) status. To mitigate potential challenges from losing preferential market access, Bangladesh has proactively developed a Regional Trade Agreement (RTA) Policy in 2022. Under this framework, the country has initiated negotiations for significant agreements, including an Economic Partnership Agreement (EPA) with Japan and a Comprehensive Economic Partnership Agreement (CEPA) with India. Additionally, Bangladesh has conducted 26 feasibility studies to explore Preferential Trade Agreements (PTAs), Free Trade Agreements (FTAs), CEPAs, and EPAs with major trading partners.

Regionally, Bangladesh is a member of the South Asian Association for Regional Cooperation (SAARC) and participates in the South Asian Free Trade Area (SAFTA), which succeeded the 1993 SAARC Preferential Trading Arrangement and came into force in 2006. The country also engages in the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), aiming to promote free trade in the region.

Globally, Bangladesh is an active member of the World Trade Organization (WTO), aligning its trade policies with international standards. The government’s strategic approach to trade agreements aims to bolster economic resilience and sustain growth in the post-LDC graduation era.

2.3. Legal and regulatory framework

In 2025, Bangladesh introduced significant legal reforms in cybersecurity and banking. The Cyber Security Ordinance 2024 grants the Director General of the National Cyber Security Agency extensive powers, including content restriction and user data access, raising concerns about potential overreach and infringement on freedom of expression.

Concurrently, the Bank Resolution Ordinance 2025 empowers the Bangladesh Bank to intervene in financially unstable banks, allowing actions such as appointing administrators, transferring shares, and establishing bridge banks to manage failing institutions.

These developments underscore Bangladesh’s efforts to enhance regulatory oversight in critical sectors and highlight the need to balance enforcement with the protection of fundamental rights.

2.4. Government structure and business policies

In 2025, Bangladesh is undergoing significant governmental reforms to enhance democratic governance and stimulate economic growth. The interim administration, led by Nobel laureate Muhammad Yunus, is preparing for upcoming elections and is committed to establishing a more inclusive political framework. The newly formed National Citizens’ Party (NCP), emerging from student-led movements, advocates for a “second republic,” aiming to draft a new democratic constitution that ensures broader representation.

On the economic front, the government has approved the establishment of economic zones to attract foreign investment and boost trade. Additionally, policies such as cash incentives, duty drawbacks, and subsidized financing have been introduced to support export-oriented industries. These initiatives reflect Bangladesh’s dedication to creating a conducive environment for business and investment.

3. Entering the Market

Bangladesh presents promising investment opportunities across various sectors in 2025. The Dhaka Stock Exchange (DSE) has started the year on a positive note, attracting both local and foreign investors. The Buy Now Pay Later (BNPL) market is projected to reach $1.92 billion, reflecting a growing consumer finance sector.

Additionally, the technology and renewable energy sectors are gaining traction, aligning with global trends toward sustainability. Foreign investors must obtain a business visa for short-term visits and a residence permit for extended stays. Specific industries may require approval from the Bangladesh Investment Development Authority (BIDA). It is also important to note that Bangladesh maintains strict foreign exchange controls, necessitating compliance with regulations set by the Bangladesh Bank. The legal system is rooted in English common law, with the Constitution serving as the primary legal framework. To navigate this emerging market effectively, investors are advised to utilize real-time data, diversify portfolios, adopt long-term investment strategies, and stay informed about market developments.

3.1. Overview of foreign direct investment (FDI) policies

In 2025, Bangladesh implemented strategic policies to enhance foreign direct investment (FDI), focusing on regulatory improvements, infrastructure development, and leveraging competitive advantages. A key initiative is the introduction of the FDI Heatmap, a data-driven framework targeting 19 high-potential sectors such as renewable energy, pharmaceuticals, and agro-processing. This tool serves as a strategic blueprint for guiding investment promotion efforts.

The regulatory framework has been refined to facilitate sustainable development. Under the principle of non-discrimination, 100% foreign ownership in most sectors is allowed. This approach ensures equal treatment for foreign investors, fostering a more inclusive investment environment.

Infrastructure development is a priority, and the government is enhancing facilities to support sustainable growth through FDI. These improvements aim to create a conducive environment for investors, address logistical challenges, and promote efficient operations.

To streamline investment processes, the Bangladesh Investment Development Authority (BIDA) offers a One Stop Service (OSS) portal, providing time-bound and transparent services to investors. This platform simplifies procedures, reduces bureaucratic hurdles, and expedites project implementation.

Collectively, these policies underscore Bangladesh’s commitment to attracting foreign investment by creating a favorable and competitive business landscape.

3.2. Investment promotion authorities (BIDA, BEPZA, BEZA, Hi-Tech Park Authority, BSCIC)

In 2025, Bangladesh plans to merge its existing investment promotion agencies into a single Investment Promotion Agency (IPA) to streamline investment processes and attract more Foreign Direct Investment (FDI). Currently, key agencies include:

Bangladesh Investment Development Authority (BIDA): The primary investment promotion agency responsible for facilitating local and foreign investments.

Bangladesh Export Processing Zones Authority (BEPZA): Oversees Export Processing Zones (EPZs) to boost export-oriented industries.

Bangladesh Economic Zones Authority (BEZA): Develops Economic Zones (EZs) to encourage industrial growth.

Hi-Tech Park Authority: Promotes investments in the technology sector.

Bangladesh Small and Cottage Industries Corporation (BSCIC): Supports small and cottage industries.

The new centralized IPA aims to enhance efficiency, reduce bureaucratic delays, and attract higher FDI.

3.3. Key business hubs (Dhaka, Chittagong, Barishal, Khulna)

Bangladesh’s key business hubs—Dhaka, Chittagong, Barishal, and Khulna—play vital roles in the country’s economic growth.

Dhaka, the capital and financial center, is home to corporate headquarters, industrial zones, and a thriving startup ecosystem.

Chittagong, home to the country’s largest seaport, is a gateway for international trade and a central industrial and logistics hub.

Barishal, strategically located along river routes, supports the agribusiness and fisheries industries.

Khulna, known for shipbuilding, jute processing, and seafood exports, is an emerging industrial hub.

These cities collectively drive Bangladesh’s economy, offering diverse investment opportunities across multiple sectors.

3.4. Common challenges for foreign investors

Foreign investors in Bangladesh face several challenges despite the country’s investment potential. Regulatory hurdles and bureaucratic inefficiencies can slow business registration and approvals. Foreign exchange controls make profit repatriation complex, affecting investor confidence. Infrastructure gaps, including inconsistent power supply and inadequate logistics, increase operational costs. Policy uncertainty and changes in regulations create unpredictability for long-term investments. Corruption and governance issues add to business risks. Land acquisition difficulties and disputes further complicate investments. Additionally, political instability and labor unrest pose challenges. Addressing these issues through reforms and improved governance is essential to restoring investor confidence and attracting sustainable FDI.

4.1. Work Visas and Entry Permits

Foreign nationals intending to work in Bangladesh must obtain an Employment (E) Visa, issued for an initial period of three months and extendable up to three years. Employers must secure approval from the Bangladesh Investment Development Authority (BIDA) before hiring expatriates. Upon arrival, employees must register with the local authorities and apply for a work permit within 15 days. Additionally, professionals in specific sectors may require approvals from other regulatory bodies. Stringent documentation, including employment contracts and company endorsements, is mandatory. Compliance with visa and work permit regulations is crucial to avoid penalties and legal complications.

4.2. Employment Regulations and Labor Laws

The Bangladesh Labour Act of 2006 governs employment practices, ensuring worker rights, fair wages, and safe working conditions. It sets provisions for working hours, overtime pay, contract terms, termination policies, and dispute resolution mechanisms. Employees are entitled to annual, casual, and sick leave, along with maternity benefits. The law also mandates workplace safety standards, preventing hazardous conditions. Trade unions are legally recognized, allowing collective bargaining and industrial actions. Employers must comply with local labor laws to avoid legal disputes and ensure a fair work environment. Amendments and updates to labor laws continue to align with economic and industrial developments.

4.3. Hiring Local vs. Expatriate Employees